Basic approach

The Group strives to protect the environment through its business activities in accordance with the Group Vision, which is the corporate philosophy that takes into account the natural environment and the global environment. In particular, we recognize that climate change poses serious risks, and we are actively promoting initiatives in this area.

In fiscal year 2021, we endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and participated in TCFD Consortium. Based on the recommendations, we will actively disclose information about both business risks and opportunities posed by climate changes from the perspectives of strategy and risk management.

Information disclosure based on TCFD recommendations

Governance

The Group will strive to address issues so it can help bring about a sustainable society by carrying out its wide-ranging businesses and services based on the “Group Vision,” which constitutes the Group’s philosophy, whereby the Company itself also aims at sustainable and dynamic growth.

The Company has been aggressively pursuing initiatives called “Sustainability Actions” toward realizing a sustainable society. Setting the important themes (materialities) that require particular attention and is actively pursuing initiatives aligned with these materiality areas.

In order to pursue these initiatives sustainably, aggressively and systematically, the Group has formulated the “Regulations for System Promoting Seibu Group Sustainability Actions” and has a promotional system in place. To promote Sustainability Actions groupwide, the Seibu Group Sustainability Committee has been set as the organization that strongly pushes forward with efforts by determining the direction of Sustainability Actions, monitoring their progress, and using other means. The Committee is headed and chaired by CEO of Seibu Holdings and is composed of the President and Representative Director, President and COO of Seibu Holdings and the Executive Officer in Charge of the Corporate Strategy Department of Seibu Holdings—the organization responsible for promoting Sustainability Actions and formulating group business plans—and the presidents of the main business companies in the Seibu Group. The Committee monitors initiatives based on the TCFD recommendations and decides on their direction through activities, such as keeping track of initiatives for reducing CO2 emissions, which are the main cause of global warming, and discussing how to identify and respond to climate change risks. The contents of discussions in the Committee are reported at meetings of the Board of Directors.

Click here for details of the promotion system.

Strategy

We have held discussions on climate change related strategies including identifying risks/opportunities and assessing their impacts at the Seibu Group Sustainability Committee in the following steps. The Seibu Group Sustainability Committee will continue to monitor progress of these plans.

- STEP1: Identifying climate-related risks/opportunities

- STEP2: Defining a group of scenarios

- STEP3: Assessing business impacts

- STEP4: Planning/Implementing countermeasures

Businesses subject to scenario analysis:

Real Estate, and Hotel and Leisure, and Urban Transportation and Regional

- IEA NZE Scenario

- IPCC RCP8.5 Scenario

Reference scenarios:

STEP1: Identifying climate-related risks/opportunities

We identified climate-related risks and opportunities that were likely to affect our businesses. We classified them into transition risks associated with the transition to a low-carbon society, physical risks related to physical changes caused by climate change, and the opportunities that may arise.

STEP2: Defining a group of scenarios

We deliberate on multiple scenarios including the IEA NZE Scenario in which the world works to keep the rise in the average temperature to less than 1.5℃, and the IPCC RCP8.5 Scenario in which the global average temperature at the end of this century rises by 4℃ to cope with uncertainty in business.

STEP3: Assessment of Impact

We analyze the impact of the risk and opportunity items identified in STEP1 quantitatively and qualitatively based on different scenarios assumed in STEP2.

| Category | Risk items | Impacts | Period | Exposure | Main measures to be taken | |

|---|---|---|---|---|---|---|

| Transition risk |

Policy, laws and regulations | Increase in costs due to the introduction of a carbon tax | 【All segments】 ・Increase in costs related to Scope 1 and 2 direct emissions due to introduction of carbon tax (approx. ¥3.8 billion in 2030) |

Medium | Large |

・Reduction of energy use through energy saving ・In-house generation or external procurement of renewable energy ・Optimization of capital investment and equipment renewal plans ・Introduction of internal carbon pricing |

| 【All segments】 ・Increase in potential costs related to Scope 3 emissions due to introduction of equipment (purchase of capital goods) with high carbon emissions |

Medium | Small | ||||

| Increase in costs to address stricter carbon emission targets and tightening regulations | 【All segments】 ・Increase in costs due to renewal of equipment to comply with regulations, etc. |

Mid-to-long | Large | |||

| 【Real Estate, and Hotel and Leisure】 ・Increase in costs associated with introduction of a cap-and-trade system |

Mid-to-long | Large | ||||

| 【Real Estate, and Hotel and Leisure】 ・Increase in costs associated with acquisition of environment or third-party certifications |

Medium | Small | ||||

| Market | Increase in energy procurement costs | 【All segments】 ・Increase in costs due to change in energy mix |

Short | Small | ・Long-term fixed contracts for renewable energy | |

| Increase in material procurement costs | 【All segments】 ・Increase in costs related to production, manufacturing, transportation, and waste disposal |

Medium | Small | ・Communication and relationship building with supply chains ・Timely procurement and use of demand forecasting |

||

| Reputation | Disengagement of stakeholders due to changing values | 【Real Estate, and Hotel and Leisure】 ・Decline in occupancy rates and unit prices (rents and hotel charges) for properties without environmental certifications or those with high environmental impact 【Urban Transportation and Regional】 ・Decrease in sales due to the shift of sustainability conscious users to other services |

Mid-to-long | Moderate | ・Customer acquisition through sustainability initiatives, and promotion of dialogue with stakeholders ・Acquisition of environmental certifications ・Reduction of energy use through energy saving ・In-house generation or external procurement of renewable energy ・Optimization of capital investment and equipment renewal plans |

|

| 【All segments】 ・Difficult to acquire human resources |

Medium | Small | ||||

| Physical risk | Acute | Impact on business due to extreme weather conditions | 【All segments】 ・Decrease in sales due to closure or decline in occupancy rates caused by typhoons, floods or landslide disaster (approx. ¥400 million in the Urban Transportation and Regional segment, assuming a typhoon or other disaster equivalent to the past one) |

Mid-to-long | Small | ・Flooding and waterproofing measures at each facility, and identification and response to landslide hazard areas, etc. |

| Impact on facilities, equipment and buildings due to extreme weather events | 【All segments】 ・Increase in costs due to repairs to facilities and equipment |

Mid-to-long | Small | |||

| Chronic | Impact of global warming on business areas and domains | 【All segments】 ・Decrease in sales as everyone stays indoor in summer ・Increase in occupational accidents due to heatstroke ・Increase in costs due to increased air conditioning operation |

Mid-to-long | Small | ・Installation of equipment that allows business continuity ・Dispersion of service deployment locations ・Improvement of the work environment, and reduction of outdoor work through labor savings ・Promotion of energy saving |

| Opportunity items | Impacts | Period | Exposure | Main measures to be taken | |

|---|---|---|---|---|---|

| Opportunity | Decrease in power and utility costs due to energy efficiency improvements | 【All segments】 ・Decreases in electricity consumption and costs due to improved efficiency, and prevention of possible future increase in energy costs |

Medium | Large | ・Reduction of energy consumption through appropriate equipment upgrades ・Introduction of renewable energ |

| Expansion of renewable energy | 【All segments】 ・Increase in sales through expansion of renewable energy business ・Reduction of CO2 emissions through on-site consumption |

Medium | Large | ・Promotion of renewable energy projects, biomass power generation projects, etc., aiming at effective use of company-owned land and forests ・Expansion of forest business |

|

| Effective use of company-owned forests | 【All segments】 ・Increase in sales by use of forest assets |

Mid-to-long | Moderate | ||

| 【All segments】 ・Increase in sales through expansion of biomass power generation business |

Mid-to-long | Moderate | |||

| Preference for services and facilities with low environmental impact | 【Real Estate】 ・Increase in occupancy rates and rents for properties with environmental certifications or those with low environmental impact 【Urban Transportation and Regional】 ・Increase in sales through improved transportation efficiency and preferences for less environmentally burdensome modes of transportation |

Mid-to-long | Moderate | ・Customer acquisition through sustainability initiatives ・Promotion of dialogue and cooperation with stakeholders ・Acquisition of environmental certifications ・Reduction of energy use through energy saving ・In-house generation or external procurement of renewable energy ・Optimization of capital investment and equipment renewal plans ・Issuance of sustainability-linked loans |

|

| Investor preference | 【All segments】 ・Decrease in financing costs due to recognition of sustainability initiatives, and positive impact on stock price |

Medium | Small | ||

| Preference for facilities and services with high disaster prevention functions | 【All segments】 ・Increase in sales as disaster preparedness-conscious users use our facilities and services |

Medium | Small | ・Promotion of disaster prevention measures at each facility ・Disaster supplies stockpiled at each facility |

【Period】 Short: 1-3 years, Medium: 4-10 years, Long: 10 years or more

STEP4: Planning/Implementing countermeasures

We are proceeding with efforts to manage “risks” appropriately and turn “opportunities” into business opportunities. Meanwhile, the Seibu Group Sustainability Committee and other committees will continue to monitor the progress of these activities.

For details, please refer to the Environmental Measures section.

https://www.seibuholdings.co.jp/en/sustainability/environment/

Risk Management

The Seibu Group Sustainability Committee identifies climate-related risks. Afterward, the risks and opportunities analyzed and assessed are addressed appropriately through corresponding Sustainability Actions by the Sustainability Actions Promotion System and suitable risk management by the Risk Management System.

In addition, climate change risks are set as particularly important risks in the “Risk Management Plan,” which is formulated annually based on the “Regulations for Seibu Group Risk Management,” and are controlled after being integrated into the group-wide risk management.

Please refer to the following link for details on Risk Management.

https://www.seibuholdings.co.jp/en/ir/management/risk/

Indicators and Goals

The Seibu Group has adopted "greenhouse gas reduction" as one of its important themes (materialities) and has been actively striving to reduce emissions.

Previously, we had set targets for reducing environmental impact in order to reduce CO2 emissions. In fiscal year 2022, we revised our targets for reducing environmental impact in order to further reduce environmental impact.

As a long-term goal, we set a new target of net zero CO2 emissions for fiscal year 2050.

To achieve our long-term target, we also established a medium-term target of a 46% reduction by fiscal year 2030 compared to fiscal year 2018, and set a short-term target of a 5% reduction compared to the previous fiscal year. In addition, we have established new targets for the introduction of renewable energy, which is essential for reducing CO2 emissions.

By continuing to reduce CO2 emissions, we will fulfill our social responsibilities as a company responsible for public transport and strive to manage risks and acquire business opportunities associated with the transition to a carbon-free society.

Our reduction target for Environmental Impact

CO2 emissions reduction targets

Long-term target: Net zero emissions in FY2050

Medium-term target: 46% reduction from FY2018 level by FY2030

Short-term target: 5% reduction on a year-over-year basis every fiscal year

Target rates of renewable energy

Long-term target: 100% in FY2050

Medium-term target: 50% in FY2030

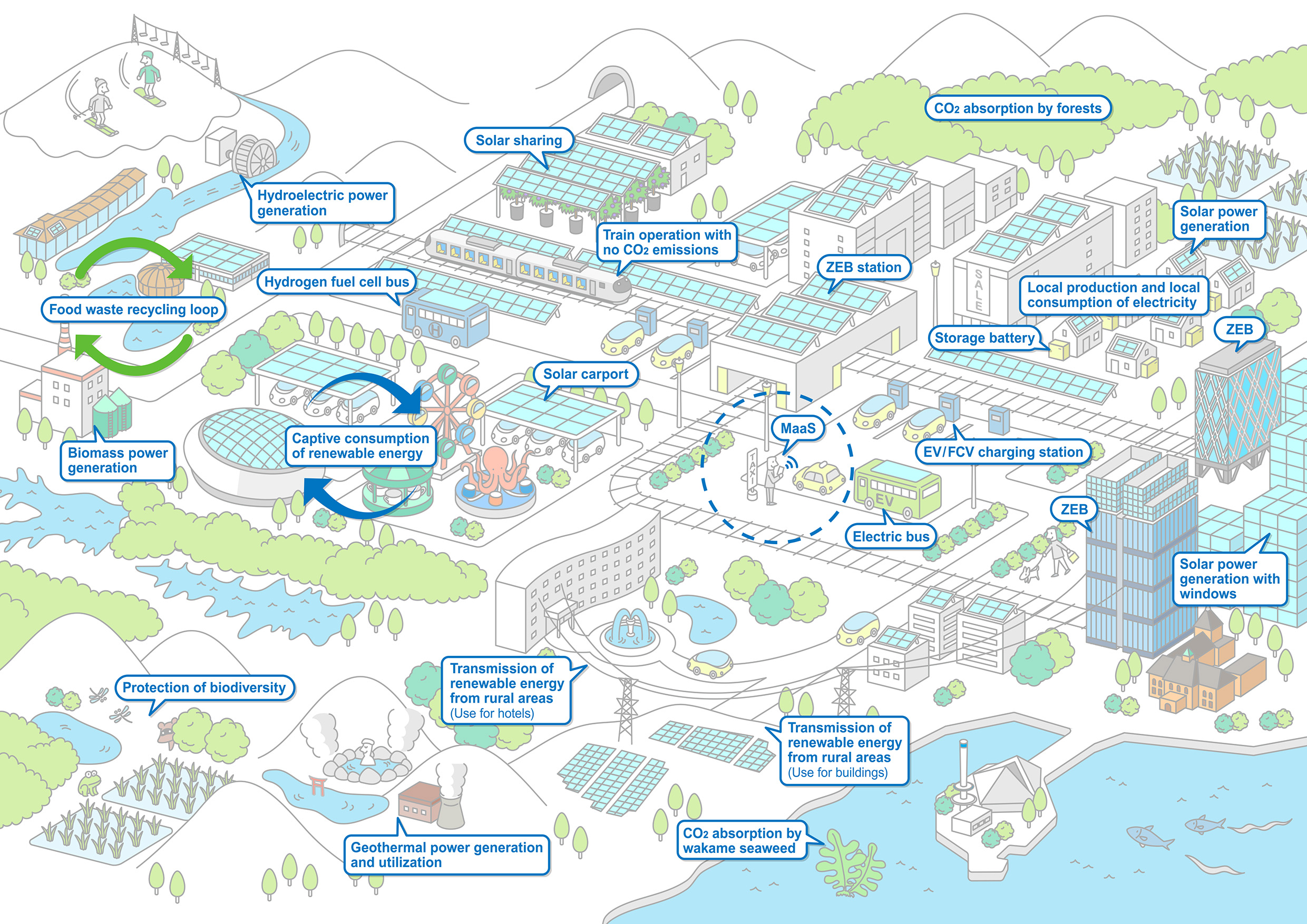

Seibu Group's vision for society in 2050

We will make unified efforts to actively promote adequate measures for the “reduction of energy consumption,” “energy transition,” and “absorption of CO2 emitted” to achieve those targets and cope with associated climate change risks and opportunities.

Please refer to the following link for details on Seibu Group-wide CO2 emissions.

https://www.seibuholdings.co.jp/en/sustainability/esg_data/

Internal Carbon Pricing System

We have introduced the Internal Carbon Pricing System to strongly advance our response to climate change. We apply an internal carbon price (7,000 yen/t-CO2) to some capital investments that can reduce CO2 emissions to aid investment decisions.

Promoting Diversity

Promoting Diversity SEIBU

SEIBU