In response to megatrends and recent changes in the business environment, the Seibu Group has newly formulated “Seibu Group’s Long-term Strategy to 2035” (hereinafter, “Long-term Strategy”), which consists of growth strategies centered on the Real Estate business, in order to maximize social value and corporate value by leveraging the strengths of the Group. We have set “Resilience & Sustainability” as our outcome for 2035, and aim to be a corporate group that “creates invaluable space and time, ensuring safety and security.”

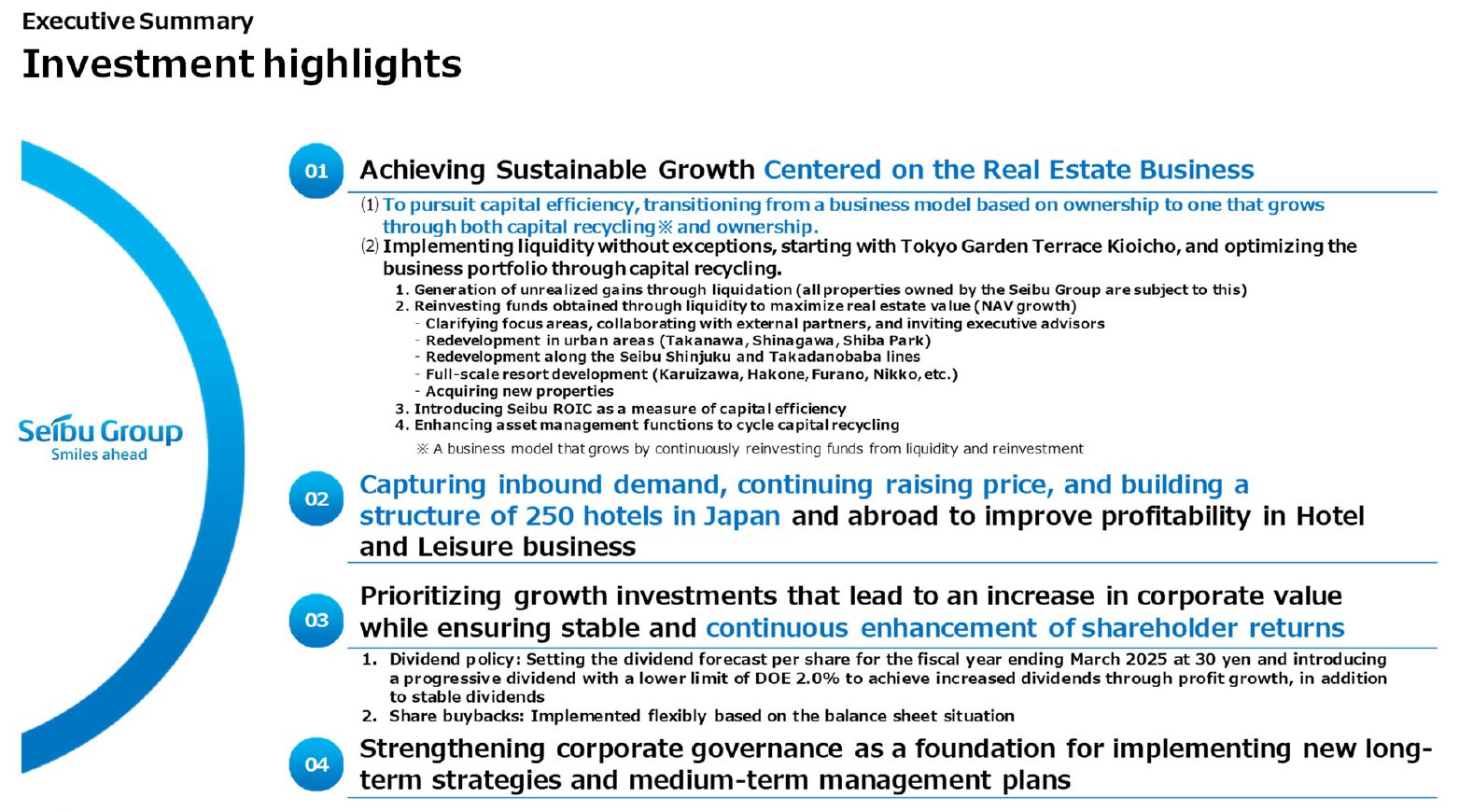

To this end, we will implement the following four initiatives and manage the Company with an emphasis on stock price and cost of capital, aiming for sustainable and sound growth.

<Key Initiatives in the Long-term Strategy and the New Medium-term Management Plan>

1. Achieving sustainable growth centered on the Real Estate business

(1)To pursuit capital efficiency, transitioning from a business model based on ownership to one that grows through both capital recycling* and ownership.

*A business model that grows by continuously reinvesting funds from liquidity and reinvestment

(2)Implementing liquidity without exceptions, starting with Tokyo Garden Terrace Kioicho, and optimizing the business portfolio through capital recycling.

(A)Generation of unrealized gains through liquidation

As announced in May 2023, we will launch a capital recycling business. We will liquidate Tokyo Garden Terrace Kioicho as the biggest driving force for capital recycling. Furthermore, all properties owned by the Group, including the headquarters building, DaiyaGate Ikebukuro, will be considered for liquidation to realize unrealized gains.

(B)Reinvesting funds obtained through liquidity to maximize real estate value (NAV growth)

We will use the funds obtained through liquidation associated with the above capital recycling business to redevelop urban areas (Takanawa, Shinagawa, Shiba Koen) and areas along Seibu Railway lines (Seibu-Shinjuku, Takadanobaba), develop resorts (Karuizawa, Hakone, Furano, Nikko, etc.), and acquire new properties to maximize the value of real estate and grow NAV (Net Asset Value), while contributing to the development of society.

(C)Introducing Seibu ROIC as a measure of capital efficiency

We will introduce Seibu ROIC to increase corporate value and improve capital efficiency of each business.

(D)Enhancing asset management functions to cycle capital recycling

By April 2025, we will establish an asset management company. We will develop our AM function by differentiating the functions of the Real Estate business to enhance asset value and competitiveness.

2. Capturing inbound demand, continuing raising price, and building a structure of 250 hotels in Japan and abroad to improve profitability in Hotel and Leisure business

In the Hotel and Leisure business, we aim to become a “global hotel chain with its origins in Japan.” We plan to improve performance and establish a competitive advantage by offering loyalty programs and personalized hospitality to capture inbound tourism demand and continue to raise prices with added value. We will also strive to achieve a network of 250 hotels in Japan and abroad by FY2035, centered on MC (Management Contracts), with a view to expanding our network and improving profitability.

3. Prioritizing growth investments that lead to an increase in corporate value while ensuring stable and continuous enhancement of shareholder returns

With regard to the dividend policy, based on a dividend forecast of 30 yen per share for the fiscal year ending March 31, 2025, we will adopt a progressive dividends approach with a minimum DOE of 2.0% starting with this plan, thereby aiming to deliver stable dividend payments and raise dividends through higher earnings. In addition, we will implement share repurchases in a flexible manner in consideration of the balance sheet situation.

4. Strengthening corporate governance as a foundation for implementing new long-term strategies and medium-term management plans

To strengthen corporate governance, we are reexamining the skills of the Board of Directors to ensure that the Board of Directors has the necessary skills and to enhance the effectiveness of the Board of Directors. Based on these reviews, the skill sets of Directors, the ratio of Outside Directors, and the composition of committees are reviewed. The candidates for Directors proposed at this Annual General Meeting of Shareholders are a balanced group so that the skills each possesses complement each other.

Effective March 2024, the membership of the Nomination Advisory Committee and the Remuneration Advisory Committee has been changed to exclude internal Directors and to have all members be independent Outside Directors.

In addition, from the viewpoint of improving corporate governance, the Company’s relationship with NW Corporation, the Company’s largest shareholder, has been reviewed. Consequently, NW Corporation is no longer able to exercise voting rights in the Company. The Company will continue to examine the ideal form of this relationship, including the holding of the NW Corporation’s shares by the Group.

<Management KPIs>

To achieve operating profit of ¥100 billion or more for the Group in FY2035, we will implement the “Seibu Group’s Long-term Strategy to 2035,” which consists of growth strategies with the Real Estate business at the core. We have established “financial KPIs” for the following four management indicators of capital efficiency, optimal capital structure, etc.

・ROE Achieve 8% on a constant basis (aiming for 10% or more in FY2035)

・ROA At least 2.7%

・Capital-to-asset ratio 25 to 30%

・Rating agency evaluation Maintain “A” rating

Going forward, we will work to reach the level of these important management indicators.

The constant slogan of the Seibu Group has been, and will continue to be, “Smiles Ahead.” We aim to create an enriched and sustainable society by creating activity and excitement for customers as a company that grows together with customers and local communities. In addition, in a bid to achieve “Resilience & Sustainability: Creating Invaluable Space and Time, Ensuring Safety and Security,” we will manage the Company to maximize social value and shareholder value.

Promoting Diversity

Promoting Diversity SEIBU

SEIBU