In the spirit of the Seibu Group's “Group Vision,” the Company is working to secure the understanding and trust of stakeholders such as shareholders and investors by disclosing company information in a timely and impartial manner.

1. Information Disclosure Standards

The Company discloses information according to the Financial Instruments and Exchange Act, other laws and regulations, and the Securities Listing Regulations established by the Tokyo Stock Exchange.

Also, any other information that is believed to be beneficial to improving the understanding of the Group is proactively disclosed.

2. Methods of Information Disclosure

Information that needs to be disclosed in accordance with the Securities Listing Regulations is disclosed through the Tokyo Stock Exchange's Timely Disclosure network (TDnet) and through press releases, and soon after that is posted on the Company's website.

Also, any other information is disclosed in as impartial and widespread a manner as possible mainly by posting it on the Company's website.

3. Forward-Looking Statements

Although the information disclosed by the Company contains forward-looking statements, these statements are based on decisions made by the Company pursuant to information that is currently available to it, and contains risks and uncertainties. Accordingly, the actual performance, results, etc., may differ from those set forth in the forward-looking statements.

4. Quiet Period

To prevent leaks of information on financial results, and ensure impartiality, the Company has a quiet period prior to the presentation of financial results, generally lasting three weeks. During this period the Company refrains from answering questions or making comments on financial results. However, the Company will, as appropriate, disclose information during the quiet period in the event that earnings forecasts are expected to change significantly.

5. Other

When using the Company's website, please refer to the separately published disclaimer in addition to this disclosure policy.

Policy for Constructive Dialogue with Stakeholders

1. Basic views

The Company’s fundamental approach to supporting sustainable growth of the Group and improving corporate value and shareholder value of the same over the medium to long term is to ensure it is fully accountable to participants in capital markets (shareholders, investors, securities analysts, etc.) by using dialogue to build long-term relationships of trust so that the Company is valued appropriately.

2. IR framework

The Company has an Investor Relations Department which focuses exclusively on IR activities under the direction of the Managing Officer in charge, with CEO as the chief IR officer. To link trends in the capital market to the business strategy and to carry out enhanced IR activities, the Investor Relations Department was established as part of the Corporate Planning, which plans and manages business strategy as well as tracks management performance. Under the direction of the Managing Officer in charge of the Corporate Planning Division, the Investor Relations Department keeps itself accurately and appropriately appraised of the Group’s circumstances, and disseminates relevant information.

3. Methods of dialogue

In conducting its IR activities, the Company pursues initiatives to create an environment conducive to dialogue regarding management policy, financial standing, other information it has disclosed, and additional matters in which capital market participants are interested. In specific terms, the Company holds briefings attended by the key management personnel following its interim and year-end settlement of accounts, at which it explains to securities analysts and investors the Company’s financial situation, progress with management plans, prospective management plans, and related matters, thereby deepening dialogue. In addition, the Investor Relations Department plays a leading role in arranging for suitably qualified representatives of the Company to visit institutional investors in Japan and overseas, organize tours of the Group’s facilities, and conduct briefings for individual investors, among other initiatives. To minimize the information gap, the Company upgrades its IR-related website, preparing and disclosing English-language versions of financial documents and other materials for capital market participants overseas.

4. Feedback to the Company’s managers and management of insider information

The opinions of capital market participants obtained through IR activities are fed back to CEO and other management members as appropriate. The Company aims to use its accurate grasp of the demands of the capital markets and their participants to ensure business management that takes account of the need to improve corporate value and shareholder value. In addition, the general manager of the Investor Relations Department attends meetings of the Information Management Committee as a committee member, which designates and manages material information, keeping appraised of the situation in a timely and appropriate manner. The general manager also appropriately manages the handling of insider information during IR activities.

Internal framework for timely disclosure of corporate information

The Company considers it a basic policy to strive to ensure society’s trust and develop its businesses by reporting accurately, swiftly and fairly to its shareholders and society in general on the Group’s activities, including operating results and the status of its businesses.

To that end, the Company instituted the Seibu Group Rules on Information Management to ensure that its officers and employees are aware of which information is material, and that they manage such information appropriately. In addition to these rules, the Company also addressed the management of material information that may require timely disclosure, developing the Seibu Group Rules on Management of Material Information and Insider Trading and the Seibu Group Rules on Disclosure of Material Information, and ensuring that all Group companies are aware of these rules.

Based on these rules, the Company designated the Administration Department as the unit responsible for managing material information, and appointed the director in charge of the department as Chief Information Management Officer (hereinafter, “Group Chief Information Management Officer”). It also appointed Chief Information Management Officers at each Group company, and put the Corporate Communication Department in charge of timely disclosure.

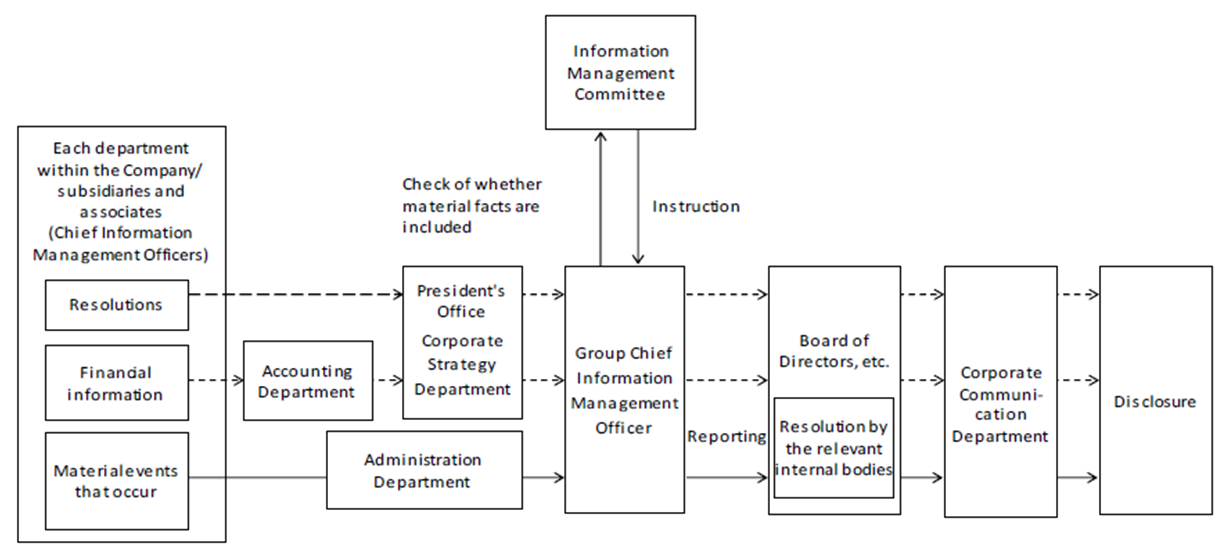

Timely disclosure procedures

The same procedures relating to timely disclosure apply to the Company and its subsidiaries and associates; the following items therefore apply to the Company as well as its subsidiaries and associates.

A) Information regarding resolutions

The Corporate Planning’s Corporate Strategy Department centrally manages the details of matters to be submitted to the Company for resolution by each Group company pursuant to the “Seibu Group Rules on Subsidiary and Associate Management” while carrying out comprehensive administration of the Group’s Medium-term Management Plan and budget. The President’s Office acts as an administrative office for the Board of Directors and the Management Council for managing the matters to be submitted for resolution to meetings and the Corporate Strategy Department and the President’s Office share information with each other on a regular basis.

Based on these submissions, the Information Management Committee investigates whether resolutions include material facts requiring timely disclosure by the Company and its Group companies. The committee comprises the Group Chief Information Management Officer and personnel responsible for information management in the President’s Office, the Corporate Communication Department, the Corporate Planning, the Corporate Strategy Department, the Investor Relations Department, and the Administration Department. If material facts requiring timely disclosure are identified, the Corporate Communication Department promptly discloses such facts, following resolution by the relevant internal bodies.

B) Information regarding material events that occur

If a material event occurs, the Company and its Group companies immediately notify the Administration Department in accordance with the Seibu Group Rules on Crisis Management and other relevant rules.

Based on such notification, the Information Management Committee investigates whether the events include material facts requiring timely disclosure by the Company and its Group companies. The committee comprises the Group Chief Information Management Officer and personnel responsible for information management in the President’s Office, the Corporate Communication Department, the Corporate Planning, the Corporate Strategy Department, the Investor Relations Department, and the Administration Department. If material facts requiring timely disclosure are identified, the Corporate Communication Department promptly discloses such facts, following resolution by the relevant internal bodies.

C) Financial information

The Accounting Department has created a framework to enable it to prepare disclosure documents including Group companies’ financial information (i.e., quarterly and annual earnings reports) in consultation with the Group Chief Information Management Officer and the Corporate Strategy Department and to disclose them within 45 days of the settlement of accounts, following resolution by the relevant internal bodies.

Promoting Diversity

Promoting Diversity SEIBU

SEIBU