Basic Views

The Seibu Group strives to maximize corporate value and shareholder value by fulfilling its social responsibilities through its business activities and earning the trust of its shareholders, customers, and all other stakeholders based on its Group Vision, which incorporates its management philosophy and management policy, and the Seibu Group Code of Corporate Ethics, which sets forth the Group's fundamental rules on compliance. To further promote corporate governance, the Group works to improve management soundness and transparency, to raise the level of and to accelerate decision-making by management, centered on the Board of Directors, and to continuously strengthen the entire Group’s internal control systems. In addition, to ensure the rights and equal treatment of shareholders, the Group engages in constructive dialogue with shareholders to improve corporate value and shareholder value over the medium to long term, and strives for timely and appropriate disclosure of information and appropriate cooperation with its stakeholders.

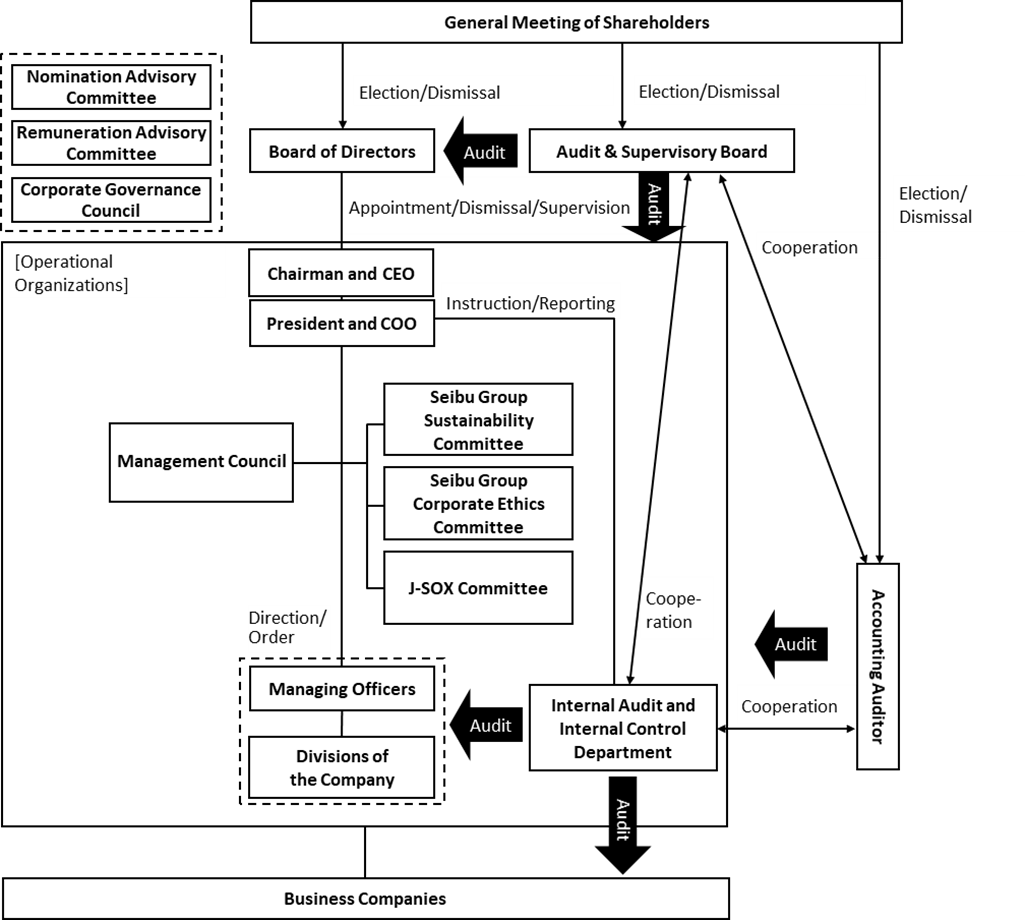

Management Structure (overview of current corporate governance system)

Seibu Holdings Inc.(The “Company”) has adopted a system of a company with Audit & Supervisory Board Members and has established the General Meeting of Shareholders, Board of Directors and Audit & Supervisory Board stipulated in the Companies Act as company organizations.

The Board of Directors is composed of 14 Directors, six of whom are outside Directors (all outside Directors are independent officers registered with the Tokyo Stock Exchange). The Board of Directors meets at least once a month in principle to make decisions on important matters related to management as well as matters stipulated by laws and regulations, and to supervise execution of business.

The Company believes that outside Directors in particular play a key role in enhancing the fairness of management from an objective and independent standpoint while reflecting their abundant knowledge and insight in management, as well as contributing to the further improvement of the corporate governance and internal control system, and accordingly has made sure that outside Directors make up 1/3 or more of all Directors.

Moreover, in order to ensure objectivity when deciding the candidates and remuneration for Directors, the Company obtains advice in the Remuneration Advisory Committee and the Nomination Advisory Committee, each chaired by an independent outside Director, and all of whose members, respectively, are independent outside Directors. The Company has established the Corporate Governance Council, which is chaired by an independent outside Director and consists of a majority of independent outside Directors and serves as an advisory body for the purpose of seeking advice from an independent and objective standpoint in carrying out analysis and evaluation of the overall effectiveness of the Board of Directors and in improving the functions of the Board of Directors.

The Audit & Supervisory Board is composed of four Audit & Supervisory Board Members, of whom two are outside Audit & Supervisory Board Members (both are independent officers registered with the Tokyo Stock Exchange). The Board meets at least once a month in principle. Each Audit & Supervisory Board Member basically audits the appropriateness and legality of the Directors’ execution of their duties by attending meetings of the Board of Directors and other important meetings and giving his opinion, exchanging opinions with the representative director, receiving verbal updates on the status of execution of business from Directors and others as required, and through other methods. Moreover, to strengthen and establish an internal control system for the entire Seibu Group, each Audit & Supervisory Board Member also conducts surveys of subsidiaries and audits them to determine whether Company-established corporate management is being conducted thoroughly.

The Company has adopted a Managing Officer system with the primary aim of ensuring swift and efficient decision making and business execution to respond flexibly to changes in the management environment. In addition, the Company has established the Management Council, composed of Directors, Managing Officers, Audit & Supervisory Board Members, Presidents of major business companies, as an organization where the Managing Officers and others deliberate on important matters, including proposals to be submitted to the Board of Directors. The Management Council holds meetings twice a month in principle to improve the quality of decision-making.

Furthermore, the Seibu Group Corporate Ethics Committee has been established as an organization to oversee the Seibu Group’s overall compliance system, composed of the President and CEO, relevant Managing Officers, Presidents of major business companies, and outside experts. The committee meets five times a year.

Furthermore, as a deliberative body concerning the preparation, operation and evaluation of internal controls relating to the Group’s financial reporting, we have established a J-SOX Committee, comprising the President and CEO, inside Directors, Presidents of major business companies, etc. which meets once per year.

Apart from this, as a body to determine the policy concerning sustainability actions and monitor the progress, we have established a Seibu Group Sustainability Committee, comprising the CEO, President, Executive Officer in charge of the Corporate Strategy Department and Presidents of major business companies, which in principle meets twice per year.

Status of internal audits and financial audits

We have established an Internal Audit and Internal Control Department, which is independent from divisions that execute business operations and reports directly to the President. In addition to the department head, nine dedicated employees are assigned to internal audits to examine and evaluate the status of business execution, and to provide suggestions and advice based on these evaluations in order to maintain soundness in the execution of business. The Group carries out internal audits of all departments with the longest cycle being three years. In the current fiscal year, we conducted 22 internal audits (including internal audits of subsidiaries) of the Company and 67 internal audits of the Group as a whole. If any findings are made during the internal audit process, follow-ups are conducted every quarter until improvements are confirmed.

The department also oversees compliance with internal control reporting system pursuant to the Financial Instruments and Exchange Act. Ten dedicated employees are assigned to this department to examine and evaluate the effectiveness and efficiency of internal control over financial reporting by each Group company, and to request improvements in a timely manner in order to maintain soundness in the execution of business through a series of evaluations and monitoring.

Internal audits are reported to the Board of Directors twice a year. An evaluation of the effectiveness of financial reporting is approved by the Board of Directors after deliberation by the J-SOX Committee. In addition, we are working to enhance the effectiveness of our efforts to maintain and improve the soundness of business execution by directly reporting internal audit results to Audit & Supervisory Board Members four times a year and to the Accounting Auditor three times a year.

Financial audits are conducted by Ernst & Young ShinNihon LLC. The certified public accountants who conducted the financial audit of the Company for FY2023 on behalf of the Accounting Auditor were YAMAZAKI Kazuhiko, SUZUKI Osamu and MORIYA Takahiro. They were assisted in the financial audit of the Company by 13 certified public accountants and 42 others.

Limitation of liability agreements

The Company has concluded limitation of liability agreements with its four outside Directors and two outside Audit & Supervisory Board Members.

Reasons for adoption of current corporate governance system

In order to conduct proper allocation of management resources, supervision of business management and other functions as a holding company, the Board of Directors of the Company is composed of Directors who are familiar with the Group’s businesses and their management, and independent outside Directors with abundant knowledge and insight. Moreover, the Company ensures the ability to improve the quality of decision-making by soliciting opinions and advice from outside Audit & Supervisory Board Members, attorneys at law, certified public accountants and other experts outside the Company.

In addition, the Company’s management believes that outside Directors and outside Audit & Supervisory Board Members contribute to further strengthening corporate governance and internal control systems by playing a role in improving management monitoring functions, including providing useful opinions and other feedback on management from a standpoint of objectivity, neutrality and independence, based on career histories, experience and knowledge that differ from those of people from inside the Company.

Through the above management structure, the Company believes it can ensure management soundness and transparency by having decision-making that takes account of a variety of opinions and views and by properly auditing and supervising the execution of business.

Corporate Governance Structure

Internal Control

Basic views on internal control system and the progress of system development

The Company recognizes that further strengthening the internal control system will contribute to maximization of the corporate value of the entire Group over the medium to long term. At the start of the fiscal year, the Company formulates an annual plan based on each of the items of the Seibu Holdings’ Basic Policy on Internal Controls, having considered the status of initiatives in the previous fiscal year, and reports the plan to the Board of Directors. At the interim period, a progress report is made to the Board of Directors and matters to be noted for the second half of the fiscal year are confirmed to ensure the effectiveness of the plan. Moreover, the execution status is verified at the end of the fiscal year and points for improvement are identified for reflection in the annual plan for the following fiscal year. In this way, a PDCA cycle is established.

Systems to ensure that business is conducted properly (The Seibu Holdings’ Basic Policy on Internal Controls)

Operating status of systems to ensure that business is conducted properly

The concrete operating status for FY2023 is as outlined below.

a. Compliance system

To continuously promote compliance-oriented management, the Company has implemented activities to entrench compliance through internal seminars and various information transmissions. Moreover, the Company strives to establish internal regulations according to its business activities so that such business activities are conducted conforming to legal and social responsibilities. With this, the Company secures a legal compliance system and realizes a compliance management at a higher level, and promptly identifies and addresses a compliance issue such as the occurrence of legal violations and harassments.

In FY2023, in addition to continuing the above activities, the Company strived to disseminate and establish the Seibu Group Human Rights Policy which we formulated in FY2022.

b. Document and information management system

Aiming for lower environmental impact and higher efficiency, the Company has actively introduced electronic documents by continuing its work on computerizing the accounting records and approval procedure, promoting a paperless and paper-stockless workplace. In addition, the Company has implemented appropriate management of both paper and electronic documents by promoting the use of electronic contracts. Through implementing these measures, the Company has streamlined operational processes in an environmentally-friendly manner.

In addition, as an effort to improve information security, the Company has implemented strong physical measures and conducted training for employees including e-learning and targeted attack e-mail training. Through this effort, the Company strives to raise employees’ information security recognition and protect corporate and customer information.

In FY2023, in continuing to practice the above activities, we shifted the workflow system to a common Group system and accelerated the introduction of electronic documents by computerizing the accounting records and approval procedure.

c. Risk management system

The Group’s risk management is based on a risk management plan formulated in each fiscal year and continuous monitoring based on the plan.

The risk management plan is formulated through three steps: (1) risk identification (extraction); (2) estimation of the risk size (analysis) and prioritization (assessment); and (3) determination of risk measures (action plan).

Risk monitoring after the plan is commenced is conducted giving consideration to risk variation due to changes in external environment and the progress of risk measures. This phase focuses particularly on a risk which would remain after risk control, a so-called residual risk, to coordinate and strengthen the measures.

In FY2023, to improve the quality of risk management, the Company established a risk management operation system which functions as an organic whole with the “Seibu Group’s Long-term Strategy to 2035” and the “FY2024-FY2026 Seibu Group’s Medium-term Management Plan” which the Group formulated. Through this, the Company will work on high-quality risk management which supports the achievement of the Group’s strategic goals.

d. System for efficient decision-making and business execution in line with management policy

To evaluate whether the Board of Directors fulfills its role and responsibilities appropriately, the Company conducts questionnaire survey to Directors and Audit & Supervisory Board Members. The survey conducts analysis and assessment by asking questions based on the Corporate Governance Code. Based on the questionnaire results, the Company holds a meeting of the Corporate Governance Council, the majority of whose members are Outside Directors, and identifies and shares issues to improve the effectiveness of the Board of Directors.

In FY2023, in formulating the “Seibu Group’s Long-term Strategy to 2035” and the “FY2024-FY2026 Seibu Group’s Medium-term Management Plan,” the Company held the Board of Directors and the Management Council meetings and other places of discussion, when necessary, where Directors including Outside Directors mainly discuss in detail from monitoring of the previous plan, analysis of changes in external environment and the movements of competitors, to formulation of long-term visions and strategies.

e. Group management system

To secure the appropriateness of the Group’s operation and identify and address issues early, the Company operates a reporting system based on the internal regulations appropriately, conducts appropriate consultations among relevant parties. In addition, the Company promptly identifies an accident and emergency situation and addresses the situation through the development and operation of a crisis management system.

To maintain and improve the quality of the Group’s audits as a whole, the Company provides training to and shared information concerning audit with each Group company. In addition, the Company inspects and evaluates all audits conducted by Group companies to improve the audit quality.

In FY2023, the Company worked to secure the appropriateness of operations amid changes in the Group’s system. In addition, as a foundation to implement the “Seibu Group’s Long-term Strategy to 2035” and the “FY2024-FY2026 Seibu Group’s Medium-term Management Plan,” the Company developed an internal management system to maintain the appropriate balance of the Group’s centripetal force and centrifugal force.

f. System relating to Audit & Supervisory Board Members

To assist the Audit & Supervisory Board Members in performing their duties, the Company allocated staff dedicated to support operations, and thus, ensured their independence.

Audit & Supervisory Board Members conducted hearings with relevant companies to secure appropriate reporting systems for Audit & Supervisory Board Members.

The Company continued the above activities in FY2023.

Promoting Diversity

Promoting Diversity SEIBU

SEIBU