▼ 1. The Group’s risk management system

▼ 2. The Group’s risk management operations

▼ 3. Overview of particularly material risk and associated risk measures

▼ 4. Overview of other major risks and associated risk measures

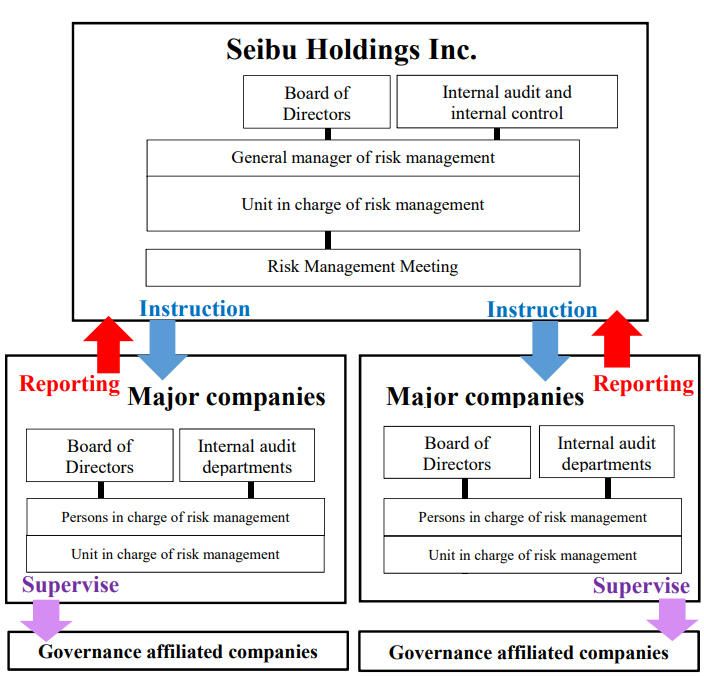

The Group’s risk management system

In order to accurately ascertain all manner of risks related to business activities and reduce the frequency of risk occurrence and impact on management for the Group, the Company’s Corporate Strategy Department has been designated as the unit in charge of risk management for the Company and the entire Seibu Group, and the executive officer in charge of business execution of the unit has been made the general manager of risk management with responsibility and authority for the entire Group’s risk management implementation and operation. At the same time, the Company holds the Risk Management Meeting, chaired by the general manager of risk management and made up of department and office general managers of the Company.

Furthermore, the seven main companies among the Group’s subsidiaries have established units in charge of risk management as departments to control internal systems related to risk management for the companies and their respective affiliated companies subject to their supervision from a governance perspective (hereinafter, “governance affiliated companies”). Executive officers responsible for the units in charge of risk management of the main seven companies are persons in charge of risk management with responsibility for implementation and operation of risk management at the companies and their respective governance affiliated companies.

Each company’s unit in charge of risk management summarizes the status of risk management and reports it to the general manager of risk management and the persons in charge of risk management. Having received the reports, the persons in charge of risk management summarize them and report to the Boards of Directors and internal audit departments of the companies, as well as to the general manager of risk management of the Company. Furthermore, the general manager of risk management summarizes them and reports to the Board of Directors and the Internal Audit and Internal Control Department of the Company.

The Group’s risk management operations

The Group’s risk management is based on a risk management plan formulated in each fiscal year and continuous monitoring based on the plan.

The risk management plan is formulated through three steps: (1) risk identification (extraction); (2) estimation of the risk size (analysis) and prioritization (assessment); and (3) determination of risk

measures (action plan)

We monitor risk subsequent to launch of the plan with a focus on residual risk (risk remaining after implementing risk controls) taking into account factors such as risk volatility associated with changes in

the external environment and progress of risk measures.

The Group will engage in high-quality risk management that facilitates achievement of the Group’s strategic targets enlisting operations functioning as an organic whole with respect to the Seibu Group’s

Long-term Strategy to 2035 (the “New Long-term Strategy”) and the FY2024-FY2026 Seibu Group’s Medium-term Management Plan (the “New Medium-term Management Plan”), formulated by the Group.

Specific details regarding the process of formulating the Group’s risk management plans are as follows.

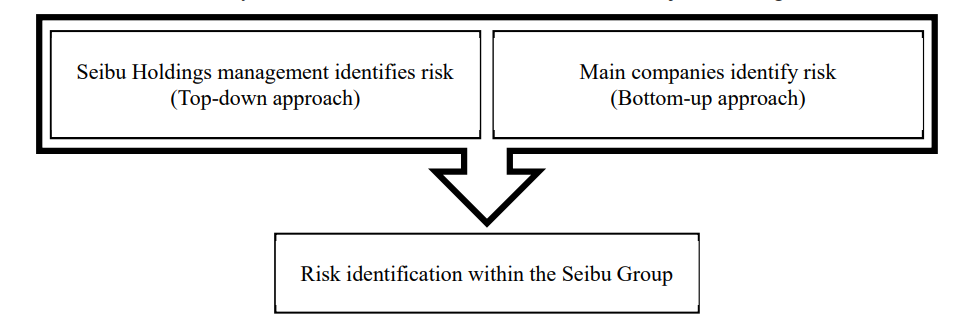

(i) Risk identification

The process of identifying risk is carried out within the Group based on both top-down and bottom up approaches, as follows.

The Company identifies risk factors that could impede progress toward achieving targets of the overall Group, which entails engaging in discussions in the Company’s Risk Management Meeting and exchanging views with the Company’s Outside Directors. At the same time, each of the seven main companies also identifies risk factors that could impede progress toward achieving targets with respect to each of the seven main companies and each of their governance affiliated companies. The Company then exhaustively identifies risk by combining the risk factors identified on both sides.

As of March 31, 2024, we have identified risk factors enlisting the aforementioned process taking into account content of the New Long-term Strategy and the New Medium-term Management Plan, and then ultimately classified and sorted the risk factors into 14 major risk categories.

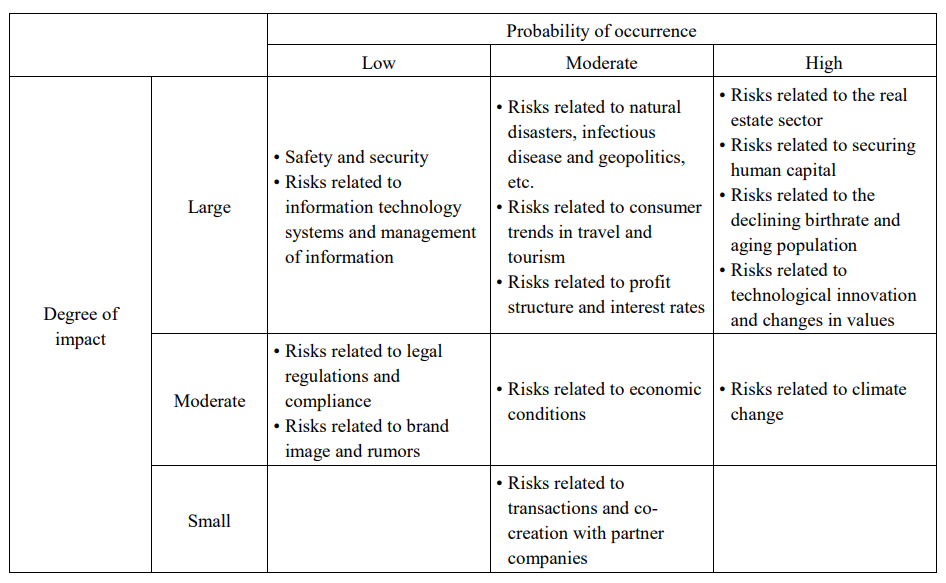

(ii) Risk analysis and assessment

The Group analyzes risk from the perspectives of probability of occurrence and degree of impact. Specifically, the seven main companies analyze risk in terms of probability of occurrence as well as degree of impact with respect to the ability of the seven main companies and each of their governance affiliated companies to achieve their targets. Meanwhile, the Company analyzes and assesses risk in terms of probability of occurrence on a Group-wide basis and degree of impact with respect to achieving the targets, taking into account the results of analysis performed by the seven main companies.

As of March 31, 2024, the Company has designated eight categories of particularly material risk from among the 14 major risk categories based on the aforementioned analysis.

Results of the analysis and assessment are as follows.

(iii) Risk measures

The Group determines specific risk measures taking into account discussions carried out regarding risk that is acceptable from a managerial perspective even if such risk persists as residual risk at the time of formulating the risk management plan.

The following sections (3) and (4) provide an overview of risk measures associated with the major risk categories. The forward-looking statements included in the following sections (3) and (4) are generally based on our evaluations as of March 31, 2024.

Overview of particularly material risk and associated risk measures

| (i) Risks related to the real estate sector | |

| Probability of occurrence: High | Degree of impact: Large |

| <Description of risk> |

|

| <Risk measures> We mitigate adverse effects potentially incurred when risks materialize by doing our utmost to promptly establish structures and functions required by general real estate companies, while also taking actions that include appointing professional talent and engaging in M&As and reorganization. With respect to risks beyond control of the Company such as (c) risk related to real estate development, we make investment decisions and conduct business in a manner that factors in occurrence of certain risks. We also mitigate adverse effects potentially incurred when risks materialize by establishing a governance system that enables us to promptly ensure in-house reporting as well as considering and implementing measures when encountering delays and abnormalities. When it comes to (d) risk of decreasing real estate value, we mitigate probabilities of risk occurrence and adverse effects potentially incurred when risks materialize in part by building a business foundation capable of withstanding risk through optimal balance sheet control and optimal portfolio development, and also by enhancing our market competitiveness through capital-efficient product planning, service upgrades, and value-added initiatives. |

|

| (ii) Risks related to securing human capital | |

| Probability of occurrence: High | Degree of impact: Large |

| <Description of risk> |

|

| <Risk measures> The Group has positioned “development and advancement of diverse human capital” as one of its materialities (objectives) under its New Long-term Strategy, and has formulated the “Seibu Group Human Capital Strategy” accordingly. We aim to serve as a “professional organization” enlisting the entire headquarters and on-site workforce by acting as an “organization that enables individuals to maximize his or her performance.” This will involve having each company of the Group endeavor to “support personal growth” by implementing initiatives to “secure human capital skills and headcount” and to “become an inspiring place to work.” On a Group-wide basis, we secure human capital by placing our focus on job markets that include those with respect to mid-career hires and second jobs in addition to conventional periodic recruitment of new graduates. We also strive to heighten job satisfaction to ensure that our recruited professionals and existing employees are able to play active roles within the Group. We will build an organization where employees embrace the corporate vision in joining forces to take on challenges due to our efforts to enhance personnel policies taking into account findings of our job satisfaction surveys. We will also engage in diversity and inclusion practices enlisting an open-minded attitude and a heightened sense of psychological security internally and externally. We will avoid risks by steadily implementing these measures. |

|

| (iii) Risks related to the declining birthrate and aging population | |

| Probability of occurrence: High | Degree of impact: Large |

| <Description of risk> |

|

| <Risk measures> We mitigate adverse effects potentially incurred when risks materialize through efforts that involve: executing the growth strategy centered on the Real Estate business and transforming the business portfolio in shifting to an approach of generating cash flows that facilitate the Group’s growth through capital recycling; and engaging in business portfolio management with a long-term horizon, in a manner that involves persistently taking on challenges of creating new businesses while also partnering with startup companies and other enterprises outside of the Group. Additionally, we mitigate adverse effects potentially incurred when risks materialize by strengthening our competitiveness in markets through various initiatives. In the resort development operations of the Real Estate business this involves creating high added-value international resorts. In the Hotel and Leisure business, this involves: accelerating our pace of hotel expansion by focusing on opening luxury hotel brands targeting the affluent customer segment; prompting transformation of our services by ascertaining customer needs in a timely manner while leveraging data on the Group marketing platform; and providing experiential value distinctive to the Group in pursuing comfortable service offerings for customers of all generations (facilities, hospitality, etc.). Furthermore, we will also seek to curb trends of declining birthrate and aging population as well as falling populations along railway lines of Seibu Railway Co., Ltd. (“SR”), and also reduce probabilities of risk occurrence in that regard by leveraging strengths of our robust foundations with respect to land situated along SR railway lines through efforts that include having SR and SRS work together in developing areas along SR railway lines. |

|

| (iv) Risks related to technological innovation and changes in values | |

| Probability of occurrence: High | Degree of impact: Large |

| <Description of risk> |

|

| <Risk measures> In its approach to digital transformation (DX), the Group seeks to bring about change across the entire enterprise in a manner that involves placing greater emphasis on the notion of transformation than on that of digitalization. We mitigate probabilities of risk occurrence underpinned by our awareness regarding the essential nature of digital technology and utilization of data. Accordingly to such ends, (a) we provide our Group employees with opportunities to gain digital skills and furthermore develop human capital equipped with sophisticated capabilities in analyzing and utilizing data, and (b) we seek to create unprecedented “new experiential value” for our customers, enlisting a data democratization approach with respect to the dual fronts of ensuring that every employee, in addition to designated professionals and analysts, is equipped to understand data, and ensuring that they are furthermore able to effectively implement measures. Moreover, we mitigate probabilities of risk occurrence by achieving substantial competitive advantage characterized by the Group’s distinctive approach to real estate development and town planning, railway line corridors preferred by consumers, and hotels preferred by customers and owners. This involves continuously transforming services in alignment with customer needs in a manner that entails making business decisions underpinned by data, and also involves efforts to streamline business processes. |

|

| (v) Risks related to climate change | |

| Probability of occurrence: High | Degree of impact: Moderate |

| <Description of risk> (Physical risks) Additionally, (c) we contend with conceivable risks of the Group’s business performance and financial condition becoming subject to adverse effects of factors that include potential downturn in sales, or escalating costs of renovating buildings and facilities in particular, attributable to suspension or closure of services due to intensifying severity of abnormal weather events, such as torrential rains and landslides, and (d) we also contend with conceivable risks of the Group’s business performance and financial condition becoming subject to adverse effects associated with a potential downturn in sales attributable to factors that could include a situation where people refrain from going out due to higher summer temperatures, or a situation where there are fewer skiers as a result of circumstances such as less snowfall during the winter months. |

|

| <Risk measures> Under its New Long-term Strategy, the Group has set “decarbonization and effective use of resources” as a materiality (objective) and has also set environmental impact reduction targets as well as asset and brand value enhancement indicators as non-financial KPIs. Specifically, we have set targets that include achieving net zero CO₂ emissions by FY2050 and ensuring 100% acquisition of environmental certifications (CASBEE, DBJ, etc.) with respect to office buildings with a total floor area of 30,000 m² or more. For instance, we consider and implement specific measures such as those that involve reducing energy consumption by adopting energy-efficient vehicles and facilities and adopting solar power and other forms of renewable energy. Through these initiatives, we aim to mitigate the probability of transition risk occurring. Moreover, we make every effort to ensure that physical risk does not jeopardize safety of our customers. This involves renovating buildings and facilities in particular, implementing flood prevention and control measures, and carrying out other forms of maintenance. It also involves enhancing our response capabilities through implementation of comprehensive disaster response drills and other such emergency drills. We mitigate adverse effects incurred when physical risks materialize through efforts that include business portfolio management carried out to ensure that declining sales and rising renovation costs do not have a significant adverse effect on our business performance. |

|

| (vi) Risks related to natural disasters, infectious disease and geopolitics, etc. | |

| Probability of occurrence: Moderate | Degree of impact: Large |

| <Description of risk> |

|

| <Risk measures> We have been mitigating adverse effects potentially incurred when risks materialize since Group restructuring was carried out under the previous Medium-term Management Plan primarily by having SEIBU PRINCE HOTELS WORLDWIDE INC. (SPW) enter into management contracts with respect to hotel openings. Moreover, we also mitigate adverse effects potentially incurred when risks materialize by striking a balance between consistent earnings (development and leasing operations) and sales proceeds (investment management operations) through engagement in capital recycling business. Furthermore, we also fortify disaster readiness systems by working in partnership with municipal bodies along railway lines in the Urban Transportation and Regional business, particularly with respect to the segment’s safety transportation management system. We aim to ensure the safety of our customers and employees while also minimizing adverse effects on our operations in cases where risk has materialized in a manner that is mindful of the need for coordinating and integrating our initiatives with risk management practices in relation to climate change. |

|

| (vii) Risks related to consumer trends in travel and tourism | |

| Probability of occurrence: Moderate | Degree of impact: Large |

| <Description of risk> We are subject to the possibility of incurring a downturn in sales (Hotel and Leisure business, non-commuter pass revenue in the Urban Transportation and Regional business, etc.) prompted by a decrease in the number of travelers and tourists domestically in Japan due to a slowdown in travel and tourism spending amid deterioration of the domestic economy. (Changes in circumstances overseas) Particularly in the Hotel and Leisure business, we are subject to the possibility of adversely affected business performance or conceivable delays in efforts to increase our number of hotels in overseas markets amid a scenario where political turmoil or deteriorating relations with Japan due to diplomatic issues result in consequences locally, such that could include disruption of business continuity, interruption or cessation of operations, or otherwise a downturn in the number of inbound tourists visiting Japan or cessation of inbound tourism. |

|

| <Risk measures> We mitigate adverse effects potentially incurred when risks materialize by prompting evolution of our corporate structure by transforming our business model, which was focused on an asset-light approach during the term of the previous Medium-term Management Plan. In addition, we take other actions that include strengthening marketing that does not rely on a single market, which in part entails global expansion of hotels, fortifying promotional activities to attract passengers, arranging reciprocal customer transfer between domestic facilities and overseas facilities, developing new products responding to such risks, and strengthening Group-wide membership programs and marketing activities. We mitigate adverse effects potentially incurred when risks materialize by cultivating loyal Group customers as we seek differentiation in serving as a “global hotel chain with its origins in Japan” through efforts that involve leveraging our distinctive strengths in areas that include facility design that enables guests to experience enjoyment and inspiration in all settings, MICE, and resorts, carried out in alignment with the Group materiality (objective) “creation of experience that stimulates the five senses.” |

|

| (viii) Risks related to profit structure and interest rates | |

| Probability of occurrence: Moderate | Degree of impact: Large |

| <Description of risk> We are subject to risk such that even a relatively minor decline in operating revenue could substantially affect our operating profit given that the Group’s operations are structured in a manner that a substantial proportion of its operating costs consist of personnel expenses, depreciation, and other such fixed expenses. In particular, the Group is likely to encounter a trend of rising personnel expenses going forward amid escalating momentum for wage hikes across society as a whole. (Interest rates and interest-bearing debt) Given that the Group engages in business requiring substantial capital investment on an ongoing basis, particularly in its railway operations, rising market interest rates would conceivably prompt a downturn in revenue from sale of residential units and lower real estate values due to stagnating demand for real estate purchases, in addition to escalating interest payments associated with its prevailing net interest-bearing debt and rising financing costs associated with new fund procurement. |

|

| <Risk measures> We mitigate probabilities of risk occurrence with respect to issues involving our profit structure, which is characterized by a high break-even point. This involves developing smart solutions for corporate operations involving the Group’s shared services company Seibu Process Innovation Inc. and streamlining operations of each of our businesses enlisting digital solutions, which is in addition to efforts that entail expanding our hotel network primarily by entering into management contracts as previously mentioned and improving asset efficiency by engaging in capital recycling business. Moreover, whereas we apply a moderate degree of financial leverage with respect to rising interest rates in activities such as engaging in large-scale development and acquiring new properties, we also mitigate (diversify) adverse effects potentially incurred when risks materialize with respect to rising market interest rates by enhancing liquidity, rigorously selecting capital investment options, and otherwise fortifying balance sheet management through efforts that involve seeking a more diverse range of financing sources and methods. We furthermore mitigate adverse effects potentially incurred when risks materialize with respect to rising market interest rates by drafting business plans and formulating schedules in a manner that involves monitoring capitalization rate volatility in real estate markets. |

|

Overview of other major risks and associated risk measures

| (ix) Risks related to economic conditions | |

| Probability of occurrence: Moderate | Degree of impact: Moderate |

| <Description of risk> Our business performance may be adversely affected or we may encounter difficulties with respect to continuing business activities due to rising costs of fuel, raw materials, etc. attributable to external factors that include shortages of raw materials (surging costs of raw materials) caused by climate change and natural disaster, as well as rising fuel costs caused by surging oil prices. (Currency fluctuations) Our business performance and financial condition may be adversely affected due to unexpected shifts in exchange prices under a scenario where we incur losses with respect to our consolidated financial statements presented in Japanese yen or our assets and liabilities denominated in foreign currencies. (Stock market volatility) Stock market volatility may prompt changes in the value of investment securities held by the Group, thereby resulting in losses that could adversely affect our business performance and lead to a decline in our stock price. Retirement benefit expenses and obligations for the Group’s employees are calculated based on the actuarial assumptions determined by the discount rate and the long-term expected rate of return on plan assets, etc. Any difference between actual results and actuarial assumptions or any change in the actuarial assumptions may affect the Group’s results of operations and financial condition. |

|

| <Risk measures> We mitigate adverse effects potentially incurred when risks materialize by constantly monitoring economic and market conditions, striving to swiftly make decisions on Group policies and having the Group precisely deploy those policies when circumstances change significantly, and establishing an efficient business management structure. Going forward, we will control risk enlisting initiatives that include formulating plans based on a preliminary assessment of economic conditions and taking an agile approach to addressing changes. |

|

| (x) Risks related to safety and security | |

| Probability of occurrence: Low | Degree of impact: Large |

| <Description of risk> We are subject to the possibility of encountering consequences that include erosion of social credibility, diminished reputation, or liability for damages under a potential scenario where factors such as inadequate or defective management processes for ensuring safety and quality of business assets or services, or factors such as deficient or defective safety and accident prevention processes, culminate in significant losses incurred by our customers, employees, or others as a result of our inability to preemptively avert accidents or other such incidents, or otherwise culminate in a situation where we become subject to administrative agency directives to suspend operations or make improvements. We are subject to the possibility of encountering consequences such as erosion of social credibility or loss of existing and future customers, including those associated with inbound tourism, as a result of our having inflicted harm or losses with respect to customer physical and mental well-being under potential scenarios that include incidents of food poisoning, food contamination, inclusion of ingredients that vary from those labeled, inclusion of allergens, or inclusion of ingredients subject to religious dietary restrictions. |

|

| <Risk measures> The Group vows to always prioritize safety in promoting all of our businesses and services, underpinned by the Group Philosophy of providing “safe and pleasant services.” We recognize that “safety and security” are top priority issues in the Group’s operations and take the utmost care with respect to safety management. Namely, in the Urban Transportation and Regional business we enlist the segment’s safety transportation management system in focusing on enhancing safety as well as maintaining and operating the transportation management system. Meanwhile, in the Hotel and Leisure business we furthermore engage in measures to ensure food security and implement safety measures at our facilities. Given our determination never to cause accidents or incidents that could significantly affect the lives and health of our customers enlisting such management practices on a daily basis, we will accordingly continue to mitigate probabilities of risk occurrence as well as adverse effects potentially incurred when risks materialize by persisting with our efforts to steadily implement various processes, such that include establishing safety management systems, performing safety audits, and providing safety education and training. |

|

| (xi) Risks related to information technology systems and management of information | |

| Probability of occurrence: Low | Degree of impact: Large |

| <Description of risk> In the unlikely event of a problem such as a leak of personal information, the Group may be claimed damages and the Group’s credibility may deteriorate, which could affect our Group’s business performance and financial condition. The Group’s business performance and financial condition may be subject to adverse effects of a downturn in operating revenue or additional costs incurred as a result of the Group’s business operations having been impaired amid a scenario where it encounters a serious failure of information system functionality due to factors such as accident, disaster, or human error, or otherwise amid a scenario where it is affected by system failure of other companies, such as other railway operators or railway-related service providers. |

|

| <Risk measures> In recognizing that information systems have become indispensable with respect to various aspects of its business, the Group carries out training for system failure (cyber attack) response and recovery, project management that involves introducing high-availability systems, permission audits, and safety confirmation of partner companies. Moreover, we mitigate probabilities of risk occurrence with respect to both risk associated with external factors and risk associated with internal factors through initiatives that involve: (a) ensuring establishment and operation of systems pursuant to the internal regulations of each Group company for optimal management of information, including personal information, (b) enlisting technological solutions for appropriately controlling access to our information systems with the aims of preventing unauthorized access to information, restricting access to data storage media, and monitoring application system logs to prevent intentional extraction of information, and (c) striving to raise employee awareness through e-learning and other such training programs. In addition to these initiatives going forward, we will control risk in alignment with the rapid pace of technological progress in society by improving operations in coordination with our partner companies, managing human capital, and seeking to optimize information systems. |

|

| (xii) Risks related to transactions and co-creation with partner companies | |

| Probability of occurrence: Moderate | Degree of impact: Small |

| <Description of risk> The Group’s business performance and financial condition may be adversely affected by factors that include a scenario where it encounters difficulties in collecting payments due to deterioration in the financial position of a partner company. The Group’s business activities, business performance, and financial condition may be adversely affected as a result of it having incurred additional costs due to disruption of a partner company (bankruptcy, disaster, etc.), or a situation where the Group’s business activities are affected by intentions of a partner company, under a scenario where the Group has become highly dependent on a specific partner company with whom a high volume of its business transactions are concentrated. The Group’s business performance and financial condition may be adversely affected by factors that include a scenario where a partner company has been unable to fulfill societal expectations in terms of human rights, compliance or otherwise. In seeking to achieve robust growth under its New Long-term Strategy, the Group takes an open-minded approach with respect to each and every one of its businesses in the process of co-creating new value with partner companies and engaging in M&A activities that enable the Group to assimilate and diversify aspects of corporate culture that it lacks. In so doing, we may encounter difficulties in co-creating value with our partner companies and in assimilating and diversifying corporate cultures amid a scenario where we lack criteria for selecting partner companies (business alliance partners, suppliers, external subcontractors, etc.) and lack criteria for assessing transaction details and transaction justifiability, or otherwise amid a scenario where such criteria are inappropriate. Consequently, this could cause the Group to miss out on business opportunities and could also culminate in a diminished reputation of the Group. |

|

| <Risk measures> We mitigate probabilities of risk occurrence and adverse effects potentially incurred when risks materialize by striving to ensure that the services provided to the Company or our customers by our partner companies adhere to compliance requirements and meet high standards. This involves managing and supervising our partner companies, establishing business outsourcing management systems, disclosing the Seibu Group Human Rights Policy, and requesting understanding of the policy. Moreover, we also mitigate probabilities of risk occurrence and adverse effects potentially incurred when risks materialize by cooperating with various partner companies in a multifaceted manner rather than relying on a specific partner company, and also by enlisting an approach to selecting and monitoring partner companies that involves conducting extensive verification from multiple perspectives taking into account not only fundamental aspects of management such as credit and debt management, but also considering information obtained through our positive relationships. |

|

| (xiii) Risks related to legal regulations and compliance | |

| Probability of occurrence: Low | Degree of impact: Moderate |

| <Description of risk> With the Group being subject to a wide range of legal regulations relevant to its business activities, such that include business law, environmental regulations, accounting standards, and tax code, infringement of a respective legal regulation could result in a situation where we incur criminal penalties, suspension from bidding or other such administrative action, liability for damages, or diminished reputation. Moreover, the Group is subject to the possibility of incurring costs necessary to ensure compliance with regulations if current regulations undergo major revision or if new regulations are established, thereby giving rise to the possibility of the Group’s business performance and financial condition becoming adversely affected by factors that include a situation where constraints are imposed on the Group’s activities under a scenario where it is unable to comply with such regulations. The Group may be subject to lawsuits and other legal means from third parties in connection with contract disputes, damages, labor disputes, environmental pollution, etc., or be investigated by the government. In addition to the costs of legal proceedings, in the event of an adverse judgment or order, its results of operations and financial condition could be adversely affected. |

|

| <Risk measures> We mitigate such risk by rigorously performing legal checks when entering into legal agreements, heightening legal knowledge through seminars and other such means, and appropriately responding to matters in collaboration with legal advisors. Going forward, we will continue to mitigate probabilities of risk occurrence and adverse effects potentially incurred when risks materialize by striving to comply with respective legal regulations through efforts that involve stringently adhering to legal and regulatory compliance frameworks, while furthermore compiling information and conducting in-house education on revisions to laws and regulations. |

|

| (xiv) Risks related to brand image and rumors | |

| Probability of occurrence: Low | Degree of impact: Moderate |

| <Description of risk> Given that third parties use brands that are the same as or similar to that of the Group’s brands, actions or behaviors by a third party that undermine such brand image could indirectly damage the Group’s reputation. The Group’s business performance and financial condition may be adversely affected under a scenario where the image of a Group brand incurs damage, including situations where any of the aforementioned major risks materialize with respect to the Company. |

|

| <Risk measures> We mitigate probabilities of risk occurrence and adverse effects potentially incurred when risks materialize through initiatives that include engaging in brand management, appropriately managing information, establishing disclosure systems, and implementing measures to improve CS and ES. |

|

Promoting Diversity

Promoting Diversity SEIBU

SEIBU