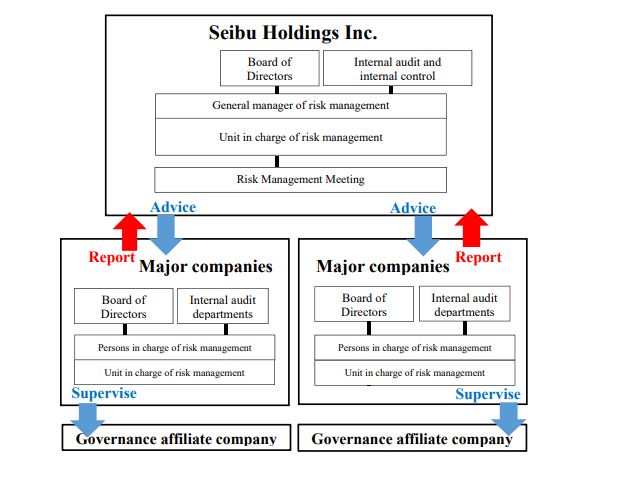

Risk management system and its operational status

In order to accurately ascertain all manner of risks related to business activities and reduce the frequency of risk occurrence and impact on management for the Group, the Company’s Corporate Strategy Department has been designated as the unit in charge of risk management for the Company and the entire Seibu Group, and the executive officer in charge of business execution of the unit has been made the general manager of risk management with responsibility and authority for the entire Group’s risk management implementation and operation. At the same time, the Company holds the Risk Management Meeting, chaired by the general manager of risk management and made up of department and office general managers of the Company.

Furthermore, the seven main companies among the Group’s subsidiaries have established units in charge of risk management as departments to control internal systems related to risk management for the companies and their respective affiliated companies subject to their supervision from a governance perspective (hereinafter, “governance affiliated companies”). Executive officers responsible for the units in charge of risk management of the main seven companies are persons in charge of risk management with responsibility for implementation and operation of risk management at the companies and their respective governance affiliated companies.

Each company’s unit in charge of risk management summarizes the status of risk management and reports it to the general manager of risk management and the persons in charge of risk management. Having received the reports, the persons in charge of risk management summarize them and report to the Boards of Directors and internal audit departments of the companies, as well as to the general manager of risk management of the Company. Furthermore, the general manager of risk management summarizes them and report to the Board of Directors and the Internal Audit and Internal Control Department of the Company.

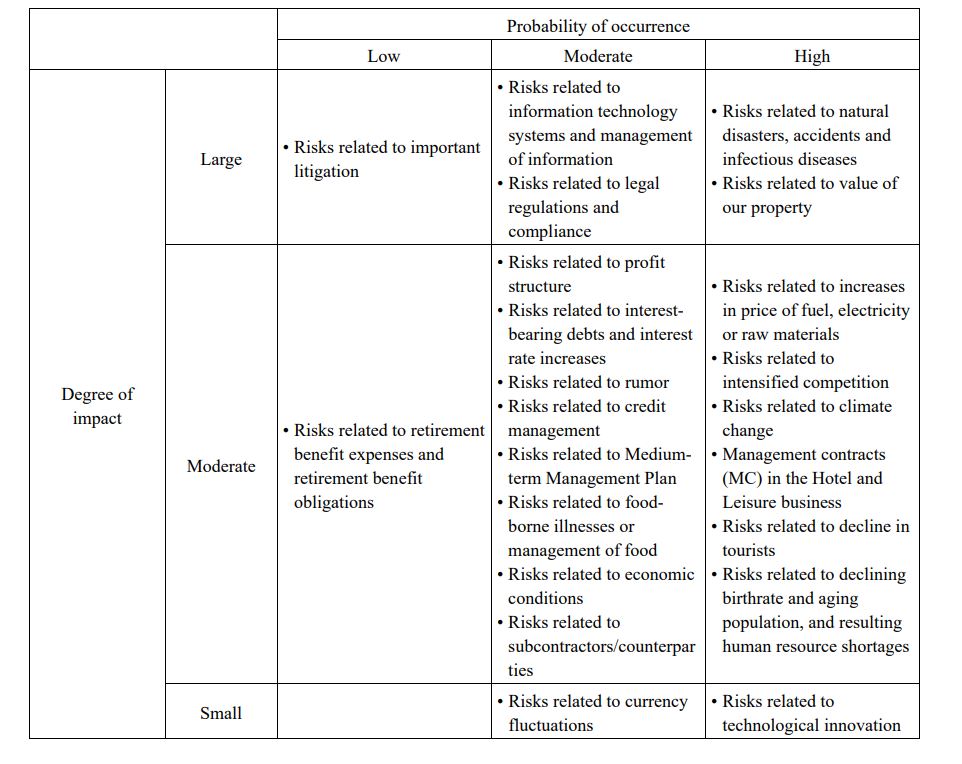

Major risks relating to the Group’s businesses and evaluation of the probability of occurrence of each risk and their impact

There are several risks relating to the Seibu Group’s, or our businesses that may have a material influence on investor decisions, mainly as described below. The probability of occurrence of each risk and their impact are evaluated as follows. Fully recognizing these risks, we are making its best efforts to prevent any occurrence of such risks or cope with such risks if any occurred.

Details of each risk and how they have been addressed

The future matters included in the following descriptions are generally based on our evaluations as of March 31, 2023.

1. Risks related to natural disasters, accidents and infectious diseases

With regard to such risk, we recognize a “high” probability of occurrence and a “large” degree of impact, as indicated above. This is because earthquakes, typhoons, torrential rains, and other natural disasters have recently had a pronounced impact all over Japan, and also because we deem that business characteristics of the Seibu Group leave it susceptible to wide-ranging impact, which includes potential outbreak of epidemics such as the COVID-19 pandemic.

We recognize that “safety and security” are top priority issues as we operate our businesses and take the utmost care with respect to safety management. Namely, in the Urban Transportation and Regional business, we focus on enhanced safety and maintain a safety transportation management system and in the Hotel and Leisure business, take the measures to ensure food security and implement safety measures at our facilities. However, a large-scale accident, natural disasters such as earthquakes, or an act of terrorism or a similar incident, may require additional costs, changes in business models, etc., which could negatively impact on our results of operations and financial condition.

Meanwhile, the Group strives to prompt evolution of its corporate structure to ensure achievement of sustainable growth under any business environment in part by transforming the business model enlisting the “asset-light” theme. Nevertheless, the Urban Transportation and Regional business and the Hotel and Leisure business could become subject to a downturn in customer numbers in the event of a typhoon or abnormal weather, such as cool summer, extreme heat, or snowfall conditions. Those businesses are also subject to concerns regarding the prospect of partial business closure or reduced willingness of people to go out and engage in leisure activities in the event of an outbreak of an epidemic for which treatment methods have not been established, such as was the case with the COVID-19 pandemic. Such scenarios could cause a downturn in operating revenue or additional costs for countermeasures, which may affect the Group’s business performance and financial condition.

2. Risks related to value of our property

Due to the nature of our businesses, namely, the railway operations and the hotel operations, we hold a significant amount of properties and other fixed assets. Therefore, this risk is recognized as having “high” probability of occurrence and “large” impact as indicated above. Although the Group carefully selects investments by managing business hurdle rates and implements various initiatives to improve the utilization and operation of existing assets, such as by refining the Group’s business portfolio by means of sales and securitization of assets and businesses (selection of non-core assets) and by considering the redevelopment of the Tokyo area and resort areas, the Group’s assets, such as real estate and securities, are subject to price volatility risks. As a result, the Group’s business performance and financial position may be affected by economic conditions or economic trends, a decline in the value of assets held due to a decline in the ability to generate cash flows, and the occurrence of impairment loss or a loss on the sale of assets.

3. Risks related to increases in price of fuel, electricity or raw materials

In connection with our Urban Transportation and Regional business, it is possible that, due to increase in the oil price, the price of fuel will increase in the bus and taxi operations, etc. In connection with the railway operations, which particularly rely on electricity supplied by TEPCO Energy Partner, Incorporated, costs for electricity may increase in the future due to a rise in the amount of the basic rate and the increase in the amount of the charges related to the promotion of renewable energy.

As a countermeasure to these risks, the Group will strive to conduct efficient business operations by constantly identifying changes in the prices of fuel, electric power, raw materials, etc., introducing energy-saving equipment and vehicles, and negotiating prices with business partners taking advantage of the scale of the Group, and will also review the service prices as necessary. However, if the prices of crude oil, electricity, and raw materials soar, the Group’s performance and financial condition may be affected.

4. Risks related to intensified competition

We are subject to significant competition in various businesses.

In the Hotel and Leisure business of the Group, the hotel business has been encountering intensifying competition, which has prompted the need for us to differentiate our services in alignment with changing consumer needs amid declining business-use and banquet demand due to the impact of the COVID-19 pandemic.

Moreover, we face further intensifying industry competition amid the market entry of existing foreign-affiliated hotels and hotels specializing in lodging, along with expansion of private lodging (minpaku) and other such forms of accommodation.

Also, our Real Estate business is subject to intense competition from competitors in operation of commercial facilities under the real estate leasing business, based on factors such as price and convenience of location.

In response to these risks, the Group is striving to maintain and strengthen its competitiveness by 1) incorporating the MICE 2.0 concept to diversify uses of hotel banquet halls nationwide—autonomous initiatives such as self-sponsored events using the Group’s internal and external content, 2) promoting Workation—work + vacation, 3) conducting chain operations utilizing one of the largest networks in Japan, 4) differentiating itself from competitors through the management of the Group’s brands, 5) considering the utilization of business alliances and acquisitions if needed, 6) promoting Sustainability Actions, 7) conducting internal reorganization of the Group aiming for enhancement of the roles of each company within the Group, and 8) enhancing Group-wide membership service programs. However, if these measures are not sufficient to secure our competitiveness, they could have an adverse effect on our results of operations and financial condition.

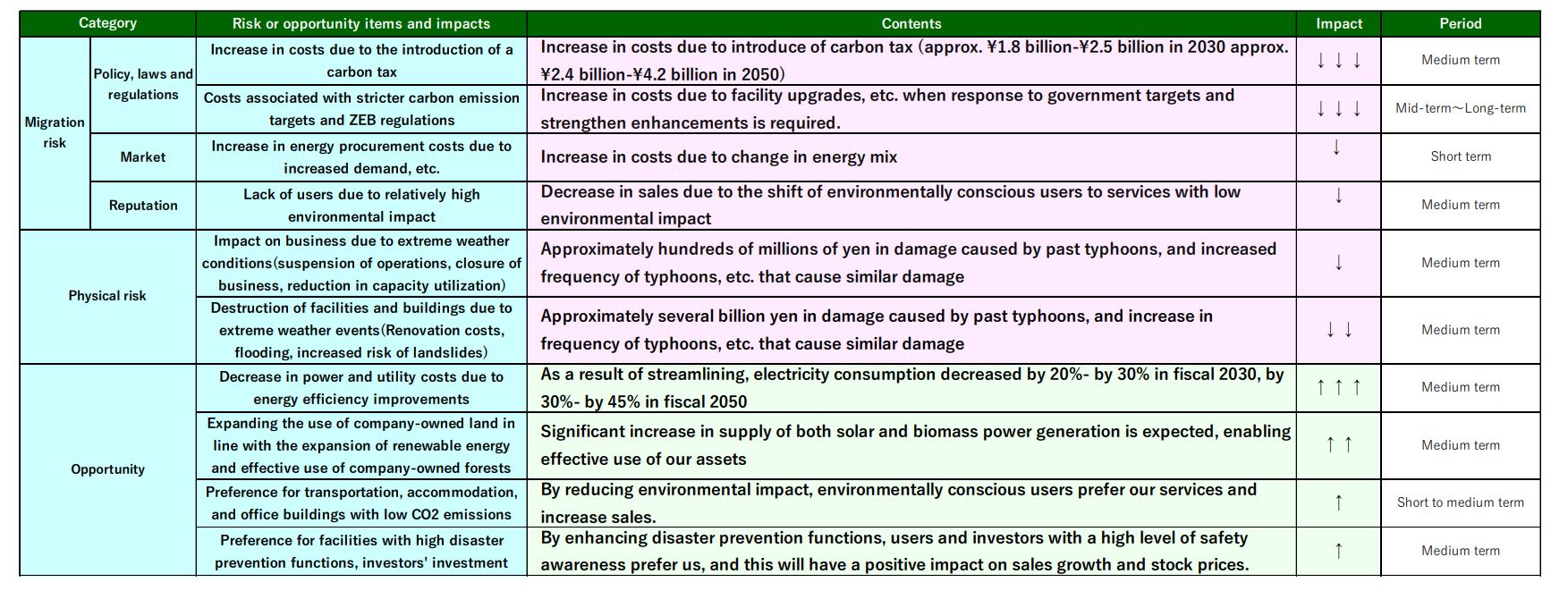

5. Risks related to climate change

The Group is exposed to the impacts of climate change, which is having increasing effects year by year, from both transition risk and physical risk.

With regard to transition risk, measures taken by every country to curb climate change, such as tightening of greenhouse gas emission restrictions and levying of a carbon tax could cause increases in electricity charges and the cost of fossil fuels that emit greenhouse cases, as well as factors such as reputation risk from being unable to cope with the transition to a low carbon society. These could have an impact on the Group’s performance and financial condition. Regarding physical risks, the Company faces possible impacts from suspension of services or business operations and increases in building repair costs due to increasing severity of abnormal weather events, such as torrential rains and landslides. In addition, people refraining from going out due to increasing summer temperatures, as well as the decline in skiers in the Hotel and Leisure business due to the decline in snowfall, could have an impact on the Group’s performance and financial condition.

(Period column: Short term: 1 to 3 years, Medium term: 4 to 10 years, Long term: 10 years or longer)

Specifically, with regard to these climate change risks, we have revised and newly established our CO2 emission reduction targets (long-term target: net zero emissions by FY2050, medium-term target: 46% reduction from the FY2018 level by FY2030, and short-term target: 5% reduction on a year-over-year basis every fiscal year), and are promoting global warming prevention measures such as introducing energy-saving vehicles and equipment, utilizing energy from natural resources such as solar power or renewable energy such as next-generation biodiesel fuel, and implementing a solar sharing project. At the same time, we execute disaster readiness measures such as conducting training to prepare of more severe disasters, formulating evacuation plans, and preparing a crisis management system. Through these efforts we are examining ways to change our business model to reduce the impacts of climate change.

In addition, the Company has expressed its agreement with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) since FY2021, and also participated in the TCFD Consortium, which discusses this initiative. The Company conducts analysis and disclosure in line with such recommendations with respect to verifying business risks and opportunities associated with climate change, particularly in terms of conducting verification enlisting multiple scenarios including a scenario where the average temperature increase attributable to climate change is kept below 2℃ and a scenario where the average temperature increases by 4℃. Moreover, along with group-wide efforts with operational departments with the Corporate Strategy Department of the Company as the unit in charge coordinating unit, we have established the Seibu Group Sustainability Committee, chaired by CEO, to continuously, proactively and systematically promote Sustainability Actions in the future, including the aforementioned reduction of GHG emissions. We have also established a system to confirm international expectations, check the Group’s situation regarding GHG emission reductions and review the related reduction initiatives, and to share information in the Group and mitigate climate change risks.

However, if we fail to respond to an unexpected and rapid transition to a carbon-free society, our Group’s performance and financial condition could be affected by a decline in operating revenue due to damage to the Group’s reputation and brand, as well as by the expense of countermeasures and the occurrence of facility upgrades.

6. Risks related to management contracts (MC) in the Hotel and Leisure business

In the Hotel and Leisure business, the Group operates hotels, golf courses, ski resorts, and other such facilities serving as an operator pursuant to management contracts that have been concluded with asset owners.

Although we strive to generate returns exceeding asset owner expectations at each business site, we are subject to the possibility of incurring a decrease in the number of hotel management contracts should it become impossible to maintain such contracts due to economic conditions and other such reasons. Such a scenario could affect the Group’s business performance and financial condition, while also affecting the Group’s timing in terms of achieving targets in serving as a global operator whose objective is that of expanding the hotel network to 250 locations both in Japan and overseas, as proclaimed in 2022.

7. Risks related to decline in tourists

Our Hotel and Leisure business may be significantly affected by trends in the Japanese tourism market, including an increase or a decrease in overseas tourists. The Japanese tourism market may be affected by various factors, including Japanese economic conditions, exchange rates, perceptions of various countries towards Japan, natural disasters, accidents and epidemics.

In addition, we operate overseas businesses mainly in U.S. State of Hawaii. Our Hawaii operations may be affected by the aforesaid factors, and changes in international conditions, including U.S. economic conditions, leading to a decline in travelers to Hawaii, which could result in a decrease in operating revenue.

In response to such risks, the Group is taking actions that entail strengthening marketing that does not rely on a single market, which in part entails global expansion of hotels, fortifying promotional activities to attract passengers, arranging reciprocal customer transfer between domestic facilities and overseas facilities, developing new products responding to such risks, and strengthening Group-wide membership programs and marketing activities. The Group is also working to prompt evolution of its corporate structure by transforming the business model enlisting the “asset-light” theme. Nevertheless, a sudden decrease in tourists in Japan or Hawaii could affect the Group’s performance and financial condition.

8. Risks related to information technology systems and management of information

We depend on various information technology systems to operate our various businesses, including our Urban Transportation and Regional business and Hotel and Leisure business. Although the Group carries out training for system failure (cyber-attack) response and recovery, project management that realizes the introduction of high-availability systems, and measures such as review of authorization and confirmation of the safety of partner companies, if a serious failure occurs in that function due to an accident, disaster, human error, etc. with respect to these systems, the Group’s business operations could be affected, and the Group’s performance and financial condition could be affected by a decrease in operating revenue or the incurrence of countermeasure costs. We are also vulnerable to system failures of other companies, such as other railway operators or railway related service providers. Furthermore, we manage the data base containing the personal information such as lists of guest or the customer data for membership services of the Hotel and Leisure business, information about the sales of season tickets or IC card tickets of the Urban Transportation and Regional business, and the customer data concerning the Real Estate business or management of point card services. The Group provides security-related education using e-learning and cyber-attack response drills, etc., and pays a close attention to the management of personal information. However, in the unlikely event of a problem such as a leak of personal information, the Group may be claimed damages and the Group’s credibility may deteriorate, which could affect our Group’s business performance and financial condition.

9. Risks related to profit structure

A substantial proportion of our operating expenses consists of fixed expenses, such as personnel and depreciation costs, particularly in the case of our Urban Transportation and Regional business, Hotel and Leisure business, and Real Estate business, among our operations, and, as a result, a relatively minor decline in operating revenue could have a significant negative impact on our operating profit. In response to these risks, the Group is carrying out management reforms with no exceptions declared in the “FY2021-FY2023 Seibu Group’s Medium-term Management Plan,” to realize an asset-light business operation by reviewing the Group’s business portfolio including sale and securitization of assets and businesses, as well as striving to lower the break-even point through reduction of fixed expenses, rigorous selection and efficient investments using different hurdle rates for each business, and to reduce costs through the work style reform. However, such an earnings structure may affect the Group’s performance and financial condition. In addition, although the Group is carrying out the aforementioned management reforms, because of the relatively large fluctuations in operating revenue particularly in the Hotel and Leisure business, the Group’s performance and financial condition may be affected if larger economic fluctuations or a new pandemic to replace COVID-19 occurs.

10. Risks related to declining birthrate and aging population, and resulting human resource shortages

The businesses operated by the Seibu Group, such as the Urban Transportation and Regional business and Hotel and Leisure business, are closely related to the daily lives of customers. Specifically, we are implementing measures in Urban Transportation and Regional business to increase the number of people living along our railway lines and in the Hotel and Leisure business, we are gearing up for a paradigm shift toward inbound tourists. However, we are concerned about a decline in passengers in connection with the railway operations and bus operations and a decline in leisure facility users due to a decline in the student and working population caused by a decreasing birthrate and aging population or a population decline in the present or future. Especially in the railway operations, the operating resources are concentrated in the Seibu Railway’s regional area, and the impact of a declining and aging population in such area is a concern. Furthermore, because we earn a significant part of its railway operating revenue from commuters, the declining day time population in Tokyo may have a negative impact on our results of operations in our Urban Transportation and Regional business.

Many of our businesses, including our Urban Transportation and Regional business, Hotel and Leisure business, require a large labor force in order to maintain efficient operations. The Group has formulated a basic concept for the Seibu Group Human Capital Strategy under the slogan of “Bringing smiles to both our customers and employees,” and has otherwise been striving to create and secure human capital by improving employee engagement and carrying out more expansive recruitment of human capital equipped with high levels of expertise and fresh insights. Nevertheless, there are concerns that it will become even more difficult in the future to recruit young employees. In these cases, the Group’s performance and financial condition may be affected.

11. Risks related to interest-bearing debts and interest rate increases

The businesses that we engage in, among others, the railway operations, require a large amount of capital expenditures on a continuous basis. Although the Group is concerned with reducing interest-bearing debts, the net balance of interest-bearing debts, excluding cash and deposits, was ¥767,312 million as of March 31, 2023.

In procuring funds, the Group is taking steps to respond to the risks of short-term interest rate increases by mainly borrowing at long-term, fixed rates, improving/maintaining funding terms, and diversifying funding methods. In addition, with the aim of achieving asset-light business operations, the Group has sold and securitized assets and businesses, and proceeded with rigorous screening of capital investments to strengthen and optimize balance sheet. However, in the event of future increases in interest rates, changes in the financial market, or downgrades followed by the company’s worsening financial condition, these factors could lead to an increase in interest expenses and make it difficult to obtain additional funds on desirable terms, including the funds required to refinance interest-bearing debt maturing at the time of repayment. These events could adversely influence our results of operations and financial condition. Furthermore we may not be able to apply sufficient funds to capital expenditures due to the repayment of borrowings.

12. Risks related to rumor

Many of our businesses provide services and products directly to retail customers under the “Seibu” and “Princehotel” brands. Although the Group implements brand management, appropriately manages information, establishes a disclosure system, and implements measures to improve CS and ES, if any of the risks described in “Business risks” becomes a reality, or if the brand image of the Group is impaired, it may affect the Group’s performance and financial condition. In addition, because there are third parties that utilize the same or similar brands, the acts or statements of such third parties which damage these brands could indirectly damage our reputation.

13. Risks related to credit management

The Group strives to strengthen its credit management system by ascertaining the financial condition of its business partners, determining the outstanding balance of receivables, and checking credit. However, the Group’s performance and financial condition may be affected by difficulties in collecting payments due to a deterioration in the financial position of its business partners.

14. Risks related to legal regulations and compliance

Having established the Seibu Group Code of Corporate Ethics and the Seibu Group Human Rights Policy, the Seibu Group strives to maximize corporate value and shareholder value by fulfilling its social responsibilities through its business activities and earning the trust of its shareholders, customers, and all other stakeholders.

The businesses we engage in are subject to various laws and regulations. To comply with any applicable law or regulation, the Group strives to comply with economic laws and regulations, gather information on revisions to laws and regulations, and conduct in-house education.

The Urban Transportation and Regional business is subject to the Railway Business Act, the Road Transportation Act and other related laws and regulations. In our railway operations, we must obtain permits from the Minister of Land, Infrastructure, Transport and Tourism for each railway line and each type of business that we engage in pursuant to the Railway Business Act (Article 3 of the Railway Business Act) and furthermore, we need the approval of such Minister in respect of setting or changing the maximum chargeable fares (Article 16 of the Railway Business Act). Our fares are currently set at the maximum chargeable fares and any increases in such fares must be approved by the Minister. As a result, if business costs increase or if any other similar events occur, such additional costs may not be absorbed by the fares at a sufficient time or to a sufficient extent.

In respect of the railway operations referred to above, the permits and approvals that the Group currently possesses have no fixed term. Any violations of the Railway Business Act, orders by the Minister under the Railway Business Act, administrative actions under them or violations of the conditions in the various permits or approvals from the Minister are subject to business suspension orders or withdrawal of such permits by such Minister (Article 30 of the Railway Business Act). As of June 21,2023, to the best of the Group’s knowledge, there are no facts that may fall under such violations and no events have occurred that may obstruct the continuance of our railway operations. However, any occurrence of such facts or events resulting in an order to suspend our business or a withdrawal of any permits from the Minister may have a significant impact on the Group’s business activities. The bus and taxi operations are also subject to regulations and are to be conducted in accordance with the permission of the general passenger automobile transportation business permits under the Road Transportation Act (Article 4 of the Road Transportation Act).

In addition, our railway operations may require investments for increased requirements related to safety, access for the disabled, energy conservation and environmental matters.

Our Hotel and Leisure business is subject to laws such as the Hotel Business Act and the Food Sanitation Act. Among other things, the hotel business is to be conducted in accordance with the business operation permits under the Hotel Business Act (Article 3 of the Hotel Business Act).

Our Real Estate business is subject to extensive national and local real estate and construction-related regulations, including the Building Lots and Buildings Transaction Business Act, the City Planning Act, the Building Standards Act, Construction Business Act and the Soil Contamination Countermeasures Act. For example, if any hazardous or toxic substances, including asbestos, are discovered on any of our properties, those properties could fall in value, and we might incur substantial costs due to being required to remediate the underlying hazard and discharge the related environmental liabilities. Furthermore, any changes in such applicable laws and regulations may require us to bear new obligations or cost increases or may regulate our rights relating to our real properties, which could result in deterioration of the value of such properties, limitations on our business scope or a significant amount of reconsideration of our development plans.

Changes in applicable laws and regulations or additional regulations could result in increased compliance costs and a failure to follow any regulations could result in restrictions on the Group’s activities or may have other adverse effects on its results of operations and financial condition.

In addition, changes to accounting standards and tax laws and policies may negatively impact our results of operations and financial condition.

15. Risks related to “Seibu Group’s Medium-term Management Plan”

The Group formulated the Medium-term Management Plan for the three-year period ending with FY2023, which sets forth the theme of “Looking ahead to our vision for the Group in a post-COVID-19 society, overcoming the impact of COVID-19 and creating a pathway for rapid growth,” in a fixed format. But if the Group is unable to achieve its management strategy, management goals, or other development plans based on this plan, its business performance and financial condition may be affected.

16. Risks related to food-borne illnesses or management of food

We provide meals and sell food in our hotels, restaurants, and stores, etc. The Group conducts food safety management systems, food safety audits, and food safety education, and pays due attention to quality control and food hygiene. However, in the event of a food poisoning accident, the Group may be subject to a suspension of operations, the Group’s reputation and brand may be damaged, and the Group’s performance and financial condition may be affected.

In addition, in the case where problems occur concerning the food hygiene and the safety and security of food by, for example, norovirus or contagious diseases that affect animals, the decrease in operating revenue or the disposal loss of inventory could adversely affect our results of operations and financial condition.

17. Risks related to economic conditions

We conduct business mainly in Japan and are thus affected by various aspects of the country’s domestic economic conditions. The Group constantly monitors economic and market conditions, and when there is a significant change in circumstances, we will swiftly make decisions based on our Group policies and operate businesses in an accurate manner, while also establishing an efficient business management structure. Nevertheless, several factors, such as lower consumer spending, deteriorating employment situation, stagnating corporate activities, shrinking demand, a downturn in the real estate market, a slump in the global economy, and geopolitical risks, etc. could have a negative impact on our results of operations and financial condition.

18. Risks related to important litigation

Although the Group strives to ensure legal checks at the time of contract agreement, obtain legal knowledge through seminars, etc., and respond to matters appropriately in collaboration with its counsels, in the ordinary course of business, it may be subject to lawsuits and other legal means from third parties in connection with contract disputes, damages, labor disputes, environmental pollution, etc., or be investigated by the government. In addition to the costs of legal proceedings, in the event of an adverse judgment or order, its results of operations and financial condition could be adversely affected.

19. Risks related to subcontractors/counterparties

The Group manages and supervises subcontractors, establishes a business outsourcing management system, discloses the Seibu Group Human Rights Policy, and requests understanding of it to ensure services provided to customers by subcontractors and counterparties are in keeping with compliance and strives to ensure they meet a high standard. However, if subcontractors or counterparties are unable to meet those standards, it could adversely affect the Group’s performance and financial condition.

20. Risks related to currency fluctuations

Although the Group monitors the funds of its overseas subsidiaries to check trends in operating revenue, planned capital expenditures, etc. from time to time, and considers efficient methods of financing by the overseas subsidiaries based on exchange rates and domestic and overseas interest rate trends, fluctuations in foreign exchange rates may reduce operating profit, which may affect the Group’s performance and financial condition.

In addition, local currency-denominated financial statements of our foreign subsidiaries are converted into Japanese yen when preparing our consolidated financial statements in yen, and thus our results of operations and financial condition may be impacted by exchange rates.

21. Risks related to technological innovation

In many of the Group’s business fields, the pace of business transformation brought about by the evolution of new technologies and their evolution is increasing at an accelerating pace.

The Group is implementing new measures with the intention of providing novel customer experience (UX/CX), securing and training digital human capital for DX, integrating Group customer information and building a Group marketing foundation, improving operational efficiency through the utilization of new technologies, and promoting partnership with the company utilizing new technology such as 5th Generation Mobile Communication System (5G), etc. However, insufficient understanding and delays in the introduction of advanced technologies could lead to customer departure due to a decline in the quality of services compared to its competitors, which could affect the Group’s performance and financial condition.

22. Risks related to retirement benefit expenses and retirement benefit obligations

Retirement benefit expenses and obligations for the Group’s employees are calculated based on the actuarial assumptions determined by the discount rate and the long-term expected rate of return on plan assets, etc. Any difference between actual results and actuarial assumptions or any change in the actuarial assumptions may affect the Group’s results of operations and financial condition.

Promoting Diversity

Promoting Diversity SEIBU

SEIBU